HRBR: Perfectly operational airline trading at 0.8x EBITDAR due to low investor awareness

Yup—Air Wisconsin has been hiding in grey market obscurity but was just forced to post earnings for the first time in 9 years, and it's trading at a ludicrous 0.8x TTM EBITDAR

6/15 Trading Update:

No news, recent bump was caused by buyers who discovered HRBR. In summary no change to price target, but I have become significantly more confident in Q2 revenue estimate, and have bumped it up in my model from $60m to $62m.

Basically I got data through 5/30 for the Chicago and DC geographies (Air Wisconsin’s two major hubs currently being serviced), extrapolated through 6/30, and then regressed the spending data against historical revenue. I got a R2 of 0.999 (after taking out two data points improve fitting) to estimate $62m of Q2 revenue. As a result there is no material change to the price target of $3.60 to $4.00, but the confidence is much higher.

05/18/21 10Q Update:

Overall good and expected earnings on what I would classify as their first “normal” earnings report. Undervaluation story hasn’t changed and multiples are still steadily re-rating. In addition, operational improvements look to be taking hold, and I’m pivoting my thesis to incorporate detail into valuations as normalized operating data becomes available, compared to the simpler deep value thesis from the good ol days.

Results:

Topline: $50m of revenue in Q1 was a -7% dip vs. $54m (normalized for the $21m UAL contract adjustment) in Q4, as expected based on historical seasonality and was actually marginally smaller than the -9% seasonality in Q1 2019.

Cost cutting: Looking at both Q4 and Q1 to understand cost cutting permanence, payroll expense was steady at $22m and operating leverage on payroll remained roughly the same as Q4 at ~45% of revenue, both ~3%p lower than pre-COVID. Maintenance was again ~17% of revenue vs. 22% pre-COVID. Both seem to imply cost cutting initiatives are likely to stay, so that’s ~8%p flowing down to EBITDAR, which out of the $250m revenue I estimate for 2021, should be around $20m. I’ll continue to look for confirmations on cost cutting permanence in Q2 and Q3 as revenues scale back up.

Outside of regular ops, HRBR is expecting to recognize $20m of PSP-2 in Q2, and another $33m of PSP-3 undated. There were no buybacks in Q1 sadly but that’s still on the menu. They put $20m of their massive $144m cash position (~$0 net debt) into ETFs this quarter.

Valuation:

Price target: HRBR should certainly be trading above $2, and comfortably above $3. This is from a DCF and multiples analysis. In terms of business operations Air Wisconsin isn’t sexy but this is an EXTREMELY durable, predictable, and cash generative business in the post-COVID environment led by an extremely stacked team of PE and Aviation veterans (see original section below).

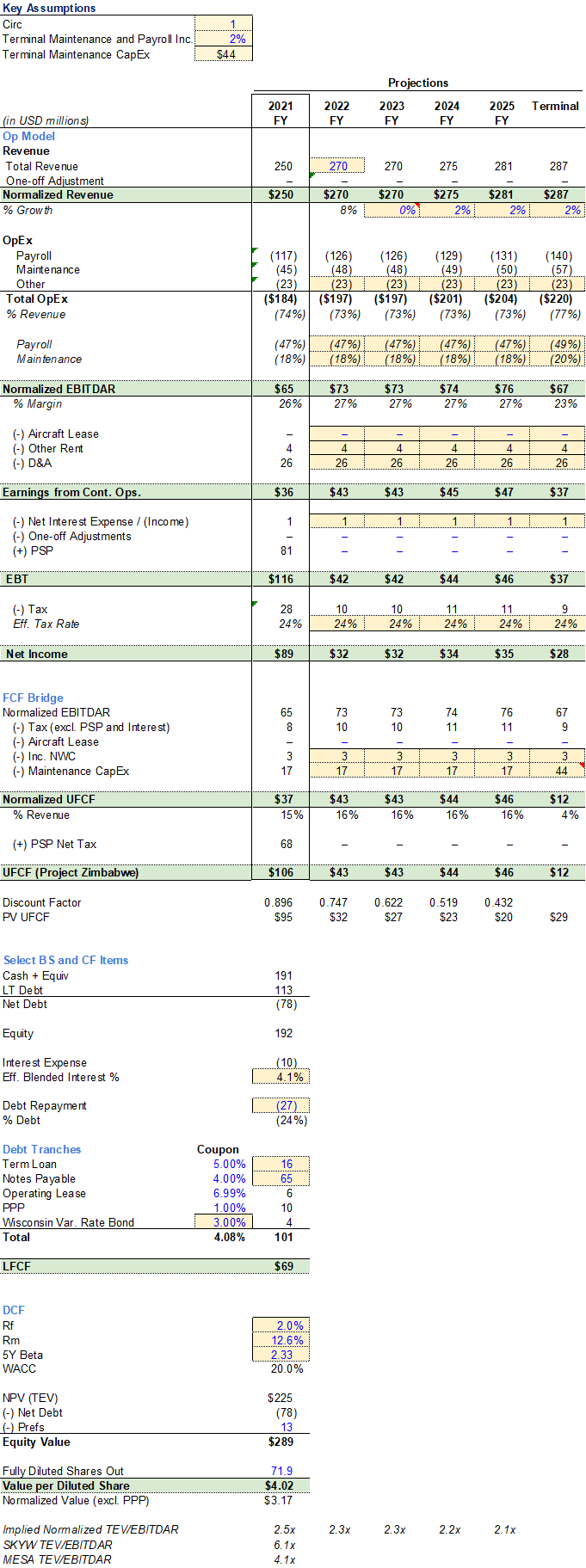

For 2021, my driving assumptions include revenue of $250m, which is almost at pre-COVID levels of $263m, and sustained cost cutting in payroll and maintenance. This gets me to $65m normalized EBITDAR and $37m normalized UFCF.

Using a discount of multiples on SKYW and MESA I get the following sensitivities:

In addition I *FINALLY* did a DCF. There weren’t enough historicals to put together a decent DCF in the past. Similar drivers as the 2021 PF except I’m assuming a higher Maintenance CapEx especially as their dingy airplanes start to fall apart, a slow down in 2022E revenue growth similar to the WFH demand slowdown we are seeing now, and a slight uptick in maintenance OpEx.

Taken together across the 3 sensitivities, here is the distribution of my analyses:

Basically, I have almost absolute certainty that fair value is above $2, and HRBR easily ought to be trading above $3.

Considerations:

The two main risks I’ve identified since the beginning were 1. going dark again and 2. controlled company. I’m VERY relieved HRBR filed this 10Q, since there’s no risk of going dark for this whole year as HRBR is now obligated to report the full year, and frankly I see this as a sign that management no longer plans to go dark in the future. The 2nd risk is still present, since Amun and Southshore own 51%, so they can always pull some shenanigans. I suppose you can risk adjust for that but the current price at $1.80 or ~1.0x EBITDAR is incredulously low.

Finally, for what it’s worth Captrust ($10b AUM RIA) initiated a mysteriously small position in HRBR, but at least it’s a start for institutional inflow :)

Hoping for buybacks and an uplisting.

Disclosure: added ~50% to original position.

04/01/21 10K Update:

2020 10K has been filed today, a couple surprises and still very undervalued with airline recovery tailwind. Say what you will about Air Wisconsin fundamentals but it is a working airline at $0.56 diluted EPS on the year trading at ~$0.80 — the risk buffer here is simply absurd.

1. Huge Q4

Looking closer at Q4, take out $8m of Q4 CARES act and $21m (one time rev adjustment due to contract amendment) and you have $7m normalized earnings ($0.10 diluted Q4 EPS) on a $54m revenue quarter ($75m recorded - $21m one time adjustment) despite a pandemic. 2021 Q1 seasonality ought to be lower so I’m guesstimating at least $55-60m revenue (compared to $61m YoY), but there should be clear runway for at least $250m revenue in 2021 (netting out COVID drag vs. pent up revenge travel) vs. $260m in 2019. Plus bottom line benefits from COVID cost cutting.

For 2021 Q1 I’d be on the watch-out for how sustainable their cost cutting was. Let’s say operating leverage on $22m of payroll can really sustainably support $54m of revenue again—2019 Payroll/Revenue was 48%, and 2021 Q4 was 43.5% which is a 10% or $12.7m reduction in payroll vs. 2019 going straight down to FCF. Aircraft maintenance and D&A ought to increase slightly due to their 2 new aircraft but rent will drop to 0. Overall based on $250m revenue I’d estimate $45m net income and ~$35m FCF in a normal year (2021 or 2022). Net debt has also been reduced from $62m when I initiated this to almost $0 and will continue this insane trajectory due to how cash generative the business is. The board directors are PE vets and are creating value not only through quick deleveraging, margin improvement, but also we minority shareholders can benefit from (likely) multiple expansion and fingers crossed some revenue growth.

5x UFCF is quite conservative meaning ~$3 share price. Comps MESA and SKYW are trading at absurd 15x and 30x forward EPS, which would put HRBR at a ludicrous $12-$24…

2. Buybacks

A milly a month, increasing by a milly a month. Does this smell like an uplisting down the road anyone???

3. PPP

And check out this thing of beauty: $28m more from Uncle Sam to be credited in Q2.

My only new concern is that HRBR is now no longer obligated to file this coming year’s reports and can go dark again (unless someone sues them again haha). But if that 2021 Q1 10Q comes out on 5/15 you bet I’ll be doubling down on this one because that means they will be obligated to file for the full 2021 year AND signals that management has decided to come out of the dark for good.

Still holding full original position despite buying and selling a few lots. Looking to add with size + maybe UAL long dated puts for increased counterparty risk.

03/01/21 Trading Update:

Tipped off someone with a large subscription newsletter posted about HRBR, guess they also see the discrepancy between price and value and pushed price up 60%. I am confidently holding my full original position in anticipation of HRBR’s 2020 10K to be released before 3/31/21, which should create much more visibility.

02/10/21 10Q Update:

2020 Q3 10Q has been filed today, so HRBR is now up to date on filings and is still alive and kicking. Q3 revenue is up to 40% of pre-COVID run rate, they have $120m of cash ($10m net debt), and at $0.35 today is trading at 0.13x run rate revenues and 0.8x run rate EBITDAR. Extremely bullish and buying with both hands—I’ve never seen anything so incredibly undervalued.

12/26/20 Original Post

Summary:

Harbor Diversified ("HRBR") was a failing pharmaceutical in the early 2010s, and was bought out for its NOLs with a $3m cash infusion from a mysterious “Amun LLC” with highly specific conditions. It went dark for about 9 years since then, and just filed its first earnings report in almost a decade after a shareholder brought it to court. Turns out, HRBR is now a holding company for Air Wisconsin (“AWI”), a regional "United Express" contractor for United Airlines.

Weird situation—yes, but what’s so interesting? Well, the market cap for HRBR is $16m even though Air Wisconsin generated $240m (2018) and $270m (2019) in revenues pre-COVID.

With $62m net debt ($78m cash), it's trading at 0.3x pre-COVID revenues and 0.8x EBITDAR.

Compare this with two other United Express contractors: Mesa Air Group (“MESA”) and Skywest Inc (“SKYW”) trade at ~1.5x pre-COVID revenues, ~2.5x 2020PF revenues, and 5 - 10x EBITDAR. Meanwhile HRBR is trading at 0.3x pre-COVID revenues, 0.5x 2020PF revenues, and 1.7x EBITDAR—about 2 - 5x lower than its peers. I highly doubt MESA and SKYW are so significantly better positioned competitively and operationally than Air Wisconsin, ceteris paribus, that such a discrepancy in valuation can be justified. The obvious risk is bankruptcy, but I contend that bankruptcy is unlikely for Air Wisconsin in the short-term. Of course this is a very risky investment given the dearth of information, but the upside massively outweighs the downside.

Based on a relative valuation with MESA and SKYW, HRBR is worth at least $1, and more likely $2+. Broader airline sector trailing multiples of 1.1x revenue and 6x EBITDAR pre-covid would result in a normal year price of $2 - $4+. A DCF yields a large range of prices, but directionally they are significantly higher than the current $0.30. In addition, NAV is $1.39, so this is a 80% discount, compared with 50% for MESA and only 10% for SKYW.

My conservative target is ~$0.70, a 130% upside.

Sections:

Background

Merits/Risks

Valuation

Catalysts

I: Background

Corporate timeline

The background for this company truly deserves its own Netflix docu-series. You’ll notice a slew of corporate events in 2011. The summary is:

Pre 2011, Harbor BioSciences was a failing and loss generating dev-stage biotech.

July 2011: An “Amun LLC” swoops in with a strictly structured deal to buy out their Net Operating Losses of over $450m with a cash infusion of $2.8m in exchange for preferred A shares with controlling voting rights, majority board seats, and a put right to abort all of this shareholders don’t approve of the NOL provision, or if they voluntarily make any filings with the SEC.

January 2012: HRBR de-registered from the SEC and went dark.

2012 - 2020: Likely some speculation in the early decade on such a peculiar deal, which ultimately died down due to lack of reporting.

April 2020: HRBR came back from the dead as “Harbor Diversified” and has to file a 10K because there are more than 300 shareholders, per 12(h)-3 of the Exchange Act. Not sure which genius brought them before the SEC to force this but s/he is the hero we need yet do not deserve. Turns out during these past 9 years, HRBR has become a holding company for Air Wisconsin, a regional contractor for United Airlines. You’ll notice a gaggle of red flags on the right—those are all late filing notices and a CPA change. These can be read as solvency/operational risks, but I will explain below why Air Wisconsin should be just fine, and deserves a significantly higher multiple and price.

Overall, my read is that in 2011, Amun wanted those NOLs as a cushion to enact the turnaround of Air Wisconsin as a private company, and someone with knowledge of this brought them back from the dark this year to leech off the returns.

Company background

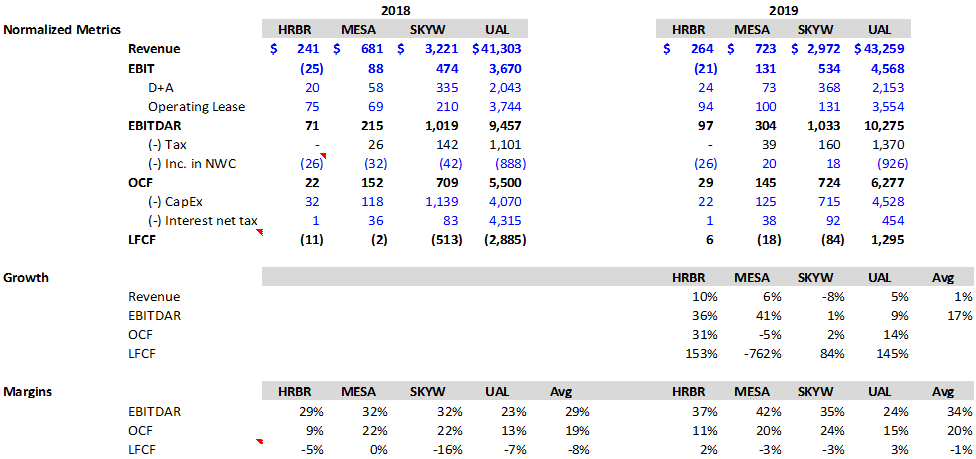

Air Wisconsin is not a fantastic airline by any means; it is above average at best when comparing revenue, growth, margins, cash flow generation, and fleet against its 2 closest public peers (Mesa and Skywest).

It does have a better growth story, but I am not really banking on it.

Compared to the rest of United Express, their capacity is below average. However the main thesis is simply around undervaluation, so future growth and secular tailwinds would only be a nice cherry on top.

II: Merits/Risks:

As long as Q2 and Q3 earnings indicate no imminent bankruptcy risk, then HRBR is grossly undervalued. Frankly, the thesis is simply that Air Wisconsin WILL NOT go bankrupt. The following mosaic approach aims to provide indications of why Air Wisconsin should be solvent and earn a consummate multiple closer to that of peers.

10 signs that HRBR will not go bankrupt:

They have enough cash for 2020.

As a result of capacity reductions and cost cutting across United, I estimate revenue at $145m and cash burn at -$135m for 2020PF. This is extrapolated from changes in revenues and variable operating expenses as a result of reduced capacity at SKYW and MESA in Q2 and Q3 applied to the reduced capacity at AWI published in its 10Q.

Step 2: Estimation of revenue and variable cost effects from AWI capacity changes based on observed effects from Q2 and Q3 for Mesa and Skywest

Step 3: Pro forma financials based on reduced capacity, effects on revenue and variable costs, and consistent assumptions on other drivers The $145m in revenue plus their $78m of cash on the balance sheet as of Q1 2020, and $44m of PPP from the CARES Act, net the -$135m cash burn should still get them to ~$50m cash by year-end before debt obligations.

They will have enough cash for 2021+.

Following negotiations and government aid, the current debt maturity for the rest of 2020 is $18.5m, which is within their $50m of cash per point #1. In addition to cash on hand, Air Wisconsin generates a modest operating cash flow of ~10%, which while slightly inferior to MESA and SKYW, should be able to cover future obligations in 2021 and 2022 of $28m per year with any semblance of normal operational cash flow. The remaining $65m in debt obligations beyond 2023 are significantly reduced to ~$10m per year thereafter.Flights are operating per scheduled.

Planned flight capacity for the full year has been reduced to ~40-50%. Flight data on flightaware.com (limited free data) confirms that flights are lower frequency but still very much operational. Normally Air Wisconsin services 350 flights a day. I looked up 4 random AWI tail codes (N463AW, N408AW, ZW3884, N455ASW) which had ~90 flights total in the past 10 days (ranging from 4 to 33). Extrapolate to their fleet of 65 CRJ-200s and you get ~145 flights per day, which is right around ~40% full capacity as planned. I see this as another confirmation that they are still operating to the standards of their amended capacity agreement with United.The AWI “turnaround” was led by an impressive set of board members / firms with aviation and PE expertise.

In the original 8K filed in 2011, Amun made it abundantly clear he needed 3 board seats (plus himself) and made a provision for having more than 7 directors (for a controlling vote). His 3 lieutenants are Kevin Degen (MD/Founder of transportation restructuring firm), Nolan Bederman (veteran Partner/Founder of MM PE fund), and Richard Bartlett (PE and aviation veteran, long time Air Wisconsin board member). Frankly this team holds one of the most prodigious CVs I have ever seen, plus JDs and MBAs spanning Harvard, Yale, Princeton.The 2 United Express bankruptcies this year were not solely caused by COVID.

TSA actually had already announced pre-COVID in February 2020 that they would transfer their assets and operations to ExpressJet, and COVID only accelerated that process. At the same time, ExpressJet also announced they would phase out some operations to Skywest and CommutAir. TSA ceased operations on April 1 and ExpressJet announced their cease of operations on July 30. If UAL hasn’t announced any plans to phase out Air Wisconsin by now, they are likely fine. On the contrary given the contract optionality in the next point, it appears United wants a future with Air Wisconsin.United wants a call option on AWI.

In October 2020 United amended their contract with Air Wisconsin to introduce several clauses, most importantly including a new optionality for United to further extend the current capacity purchase agreement for an additional 2 years after the 2 - 3 years stated in the original contract in 2018. In other words, United wants the option to continue the contract with AWI through 2022/2023. I doubt they would do that if they planned to combine AWI with MESA/SKYW like they did with ExpressJet or Trans State Airlines (“TSA”).Management expressed confidence about liquidity.

For what it’s worth, management said they have enough cash for the next 12 months in the 10Q for Q1 filed on October 22, 2020: “We believe that cash flow from operating activities, coupled with existing cash and cash equivalents, will be adequate to fund our operating and capital needs for at least the next 12 months. To the extent that results or events differ from our financial projections or business plans, our liquidity may be adversely impacted.” My analysis in point 1 corroborates this statement.They just bought 2 planes.

On September 11, 2020 Air Wisconsin bought 2 CRJ-200s that were previously leased for $0.8m total. They wouldn’t do that if insolvency was imminent.They have been hiring for months.

Their careers page, LinkedIn, and other job sites have numerous listings dating back months.Up to date web presence.

Their social media sites and website are (dare-I-say) meticulously updated. I DM’ed their Twitter and received a reply within minutes. This type of SG&A would be the first to go if they were truly in deep water.

Risks:

Management goes dark again.

Frankly, I see this as the single largest risk more than any of the operational risks below. There are several reasons management may want to go dark again:Management’s obvious incentive would be savings of $0.5 - 1m+ on compliance costs and effort which is actually material to such a small company.

Less reporting and operational complexity. They had to hire a new CPA for example, and it definitely cost them extra time and money.

Lower probability of liability for directors for any of their actions.

Confidentiality and potential competitive edge.

Freedom to explore extraordinary M&A. Maybe they want to keep the price low for a private takeout, or they have some sort of complex deal to have AWI absorbed into Mesa or Skywest like they did with TSA and ExpressJet and are personally incentivized to keep the price low.

While it is probably beneficial for management due to any of the above or other reasons to stay dark (as they have for almost a decade since Amun so indignantly required), we minority owners would not be able to reap any benefits (albeit muted because of reporting costs). This can be mitigated by continually having 300+ shareholders and legally forcing the reporting per Rule 12(h)-3 of the Exchange Act. However, Amun and his team are clearly highly sophisticated investors, and I would not be the least bit surprised if they can pull something off that is financially more beneficial to themselves but potentially at the expense of minority owners.

I am on a very keen lookout for any signs that the company is going dark again. The good news is that since they filed a 10K this FY (Jan 1 to Dec 31), they are obliged to submit all SEC mandated filings for the rest of the FY (all their 10Qs) and an EOY 10K, and will have to continue doing so in future years if there are 300+ shareholders (sorry HRBR management). Not really much that minority shareholders can do here except support activist shareholder activity and hope the HRBR directors and run with AWI’s success.

Air Wisconsin indeed goes bankrupt.

I firmly believe they will not (see above section), but if they do, ditto.United goes bankrupt.

A small hedge against any of the UAL/SKYW/MESA family or the broader JETS ETF can offset this risk plus broader sector weakness from COVID surprises.New CPA could be a going concern warning.

In November, HRBR announced a change of CPA from BDO to Grant Thornton. They cited difficulties in Topics 606 and 842. 606 relates to revenue recognition and was introduced in 2018. I assume there is nothing out of the ordinary and they are just catching up to the new reporting. 842 relates to capitalizing operating leases, and since these are already reflected on their latest balance sheet, it should again be benign. I would hope that they are just changing CPAs due to something minor, as BDO and GT are in the same cost tier.Q2 and Q3 reports are late.

They claim the tardiness is due to the change of CPA, which is understandable. This lack of information is unsettling for many, but per the evidence above I do not believe Air Wisconsin will face any major setbacks in solvency, and the high risk here from misunderstanding their financials is inherently requisite to the high potential reward.

III: Valuation

Typically I go for an absolute valuation either based on historical multiples or DCF, and use relative multiples as reference points only. I’ll admit I skimped a little this time because this is a special situation event and the result is pretty binary: either the company is going under and the stock is worth 0, or it’s not bankrupt in which case it should be worth WAY more than $0.30. In the latter case, exactly how much more it is worth is less important at this point in time, and there is also not enough information about the future of Air Wisconsin nor broader macro and sector trends to put together a believable case anyway. That could be a better exercise once Q2 and Q3 results are published. But from some relative and historical multiples, it is obvious that $0.30 is grossly undervalued for an average operating airline.

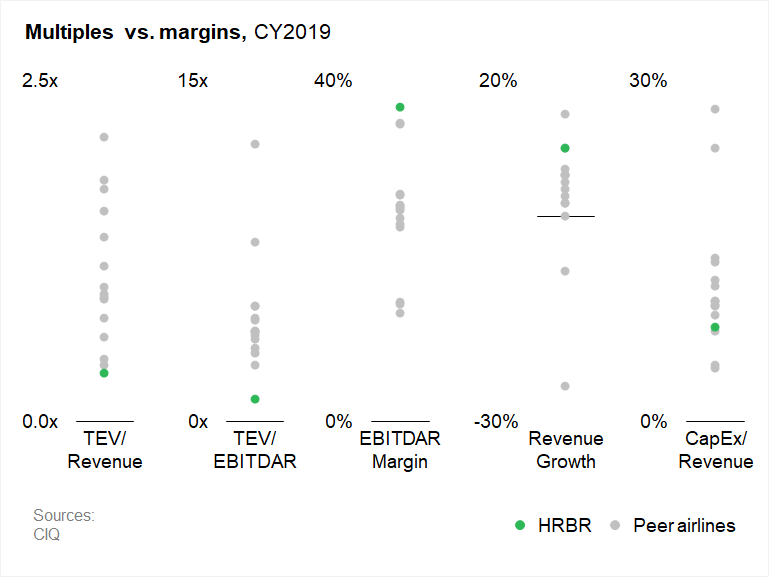

Now isn’t that a little weird—HRBR trades at the lowest multiples in the whole peer group of 15 regional and national US airlines, even though it has the highest EBITDAR margin, revenue growth, and low CapEx to boot?

Here are some other statistics on the comp set:

The football chart below lays out the implied prices of different valuations based on several peer sets and multiples.

It is a pretty binary situation so either the stock is worth 0 or way more than $0.30. The asymmetric payoff is favorable to what I deem decent odds.

IV: Catalysts:

Q2 and Q3 earnings release

Q1 was released about 5 months late in October 2020; hopefully that means Q2 and Q3 can be released some time in 2021 Q1.Visibility

Not many people know that a perfectly OK airline is trading at bankruptcy multiples under a misleading and misclassified grey market OTC ticker that hasn’t released earnings in a decade.Airline sector recovery tailwind

Disclaimer: At time of writing I am long HRBR.

The above references my opinion and is for information purposes only. I am not being compensated by any company or persons mentioned in this article. The opinions stated here do not represent my employer’s opinions. All information used is publicly available and assumed to be factual. This is not intended to be investment advice. Investing in unregulated securities bears extremely high risk.

Air Wisconsin tweeted yesterday (since deleted) that they’ll be refurbishing the interiors of the 200’s and purchasing 550’s. They made a reference about how that’ll continue their strong partnership with united... kicking myself for not taking a screenshot but was a very very strong indicator from the source itself that the partnership isn’t going anywhere.

Great analysis! Subscribed so I can watch your next calls.

I've been in HRBR since sub $.20 when I first saw the financials posted. Peeled some off between $2.50 and $3.00 and bought more under $2 this week.

Can I ask how you first discovered HRBR?