LVJI: Undervalued travel app that botched IPO or simply too good to be true

Market leading and profitable travel SaaS that IPOed 2 weeks before national lockdown with 2.8x potential upside and limited downside

Summary

Lvji (驴迹) SEHK:1745 is a self-guided tour app targeted towards Chinese domestic tourists that was founded in 2013 by Mr. Zang Weizhong (臧伟仲), a 12-year China Mobile executive. In addition to experiencing stellar growth Lvji has been profitable since 2016 and IPOed on January 16, 2020 at 2.12 HKD, and to no one’s surprise it instantly tanked as COVID lockdowns began in China within 2 weeks. It is trading at 0.90 today.

I believe the company is undervalued both intrinsically and comparatively: as the first-mover and massively dominant sector leader (85% share) with exclusivity agreements with the 2 most dominant distributors, it is poised for growth from rising adoption in the nascent sector and several COVID tailwinds. It is also a stable recurring internet business with excellent unit economics, high margins, and positive operating cash flow, with <1% debt and a large net cash position (550m RMB). Yet it is trading at bankruptcy multiples (635m RMB TEV trading at 1.2x 2019A revenues, 3.6x EBITDA), and much, much lower than comparables. Most importantly, insider and pre-IPO investor ownership is 75%, plus recent insider action is very positive, wherein the CEO bought 750k shares in the open market at 0.89, and a PIPE deal was announced last week for 50m shares at 0.90. Catalysts for price discovery include the continued release of improving domestic travel data, media coverage of the recent PIPE deal, Lvji’s annual report ~March 2021, and additional analyst coverage.

I am targeting 2.50 HKD (175% upside from current 0.90) given my valuation below, and I expect limited downside as massive recent insider buying occurred at exactly these current prices, and net cash alone is worth 0.45 — IF this company is not fraudulent.

Before going further I do want to make it very clear that this is a Chinese micro-cap with its requisite fraud risks (see LK, GSX, TAL). I have listed several potential red flags below. If these numbers are real then this asset is quite certainly undervalued; if it’s a fraud, then oh well I guess it was too good to be true anyway. In fact, an early investor and Lvji insider was a former VP at TAL. See disclaimer below, proceed with caution, DYODD. In fact, I’d like to preface all of the following with *if these numbers are not fraudulent*:

Article structure

Research motivation

Company overview

Investment merits and considerations

Financial valuation and risk

Counterfactual and wrap up

Part I: Research motivation

I’m doing this just out of curiosity and to improve my investing/modeling skillset. Lately I read this awesome report about the commonalities of the top performing 104 microcaps in the past 5 years put out by the good folk over at Alta Fox Capital. One interesting factoid was that US microcaps were significantly under-indexed in this set, whereas UK, Australian, Scandinavian, German, Austrian microcaps were significantly over-represented.

And that’s how I stumbled upon Lvji. Actually it came in 2nd place after Hummingbird Resources (AIM:HUM), a micro-cap West African gold miner which I’m also in the process of writing about so stay tuned, but Lvji was more timely given how surprisingly quickly Chinese domestic travel has recovered already.

Part II: Company overview

Quick tidbit: LVJI (驴迹) SEHK:1745 literally translates to Donkey Trail but you (might?) know how much Chinese folk love their corny puns; 驴迹 is actually a homonym for 旅迹 which more aptly translates to “tourism guide”.

Product

It’s October 2020, you’re a blue-collar Chinese worker, your quality of life and wealth has significantly improved over the past two decades and now your family affords to travel to one of China’s many AAAAA-rated tourist attractions every year during Golden Week (10/1, China’s national holiday and peak travel holiday). You’re at the Terra Cotta Army in Xi’an and already paid an extortional amount for tickets but the place is huge and you’re a little lost.

There are local teenagers loitering at the entrance offering private tours for 500 RMB (but only 300 RMB for you since tourism has been slow due to COVID). You ask the ticket agent about the exhibit’s self-guided tour: he hands you a Nokia-shaped brick with a play button, a skip button, and a hundred greasy fingerprints on it, connected to a flimsy airplane headset — he asks for 50 RMB.

That’s the status quo consumer experience at most tourist attractions and you’ve probably experienced something similar with self-guided tours, in China or elsewhere — I hope you agree it’s pretty silly that the modern tourism experience is still so barbaric. Lvji was the first mover in China to (very sensibly) digitally transform this process, making it a much simpler, better, sometimes cheaper, and now more hygienic process.

Lvji makes money by selling one-time use codes and subscriptions to Chinese tourists primarily through online travel agencies (OTAs), which tourists then use to redeem self-guided tours at various tourist attractions directly in their OTA’s app, or on the Lvji app. They currently cover about 11,000 attractions domestically and a growing number internationally as well (we’ll cover market penetration in detail later), for which there are neat little hand-drawn interactive maps that pick up your location and automatically feed you editorial info. Honestly I am not sure why this hasn’t picked up sooner.

Primary revenue drivers — digital adoption and attraction coverage

Basically there’s two approaches to build up to their digital tour guide revenue (Content Customization revenue is negligible for now):

Top down adoption approach

Lvji’s % coverage of all available attractions

X number of attractions in each tier of attractions

X avg. number of guides per attraction tier

X avg. annual revenue per guide

Bottom up content production approach

Number of guides Lvji produced

X avg. units sold per guide

X avg. price per unit per guide

I’ll use an average of both in the revenue build later but these are basically the dials that Mr. Zang can turn with the following costs:

Primary cost drivers — content production and OTA concession fees

The content production process starts by physically going to tourist attractions and recording GPS coordinates and other facility information manually, then they either use this info themselves or supply it through their “Content Customization” business and work with the tourist administration for their own digital tour guide system in a white-label / consulting relationship. Content customization currently only represents ~3% of their business, but I like that they are building out this foundational capability now because this could absolutely be a pivot if the economics or regulatory environment makes more sense down the road to simply become a white label supplier. The remaining 97% of revenue comes from their distributor network aka OTAs.

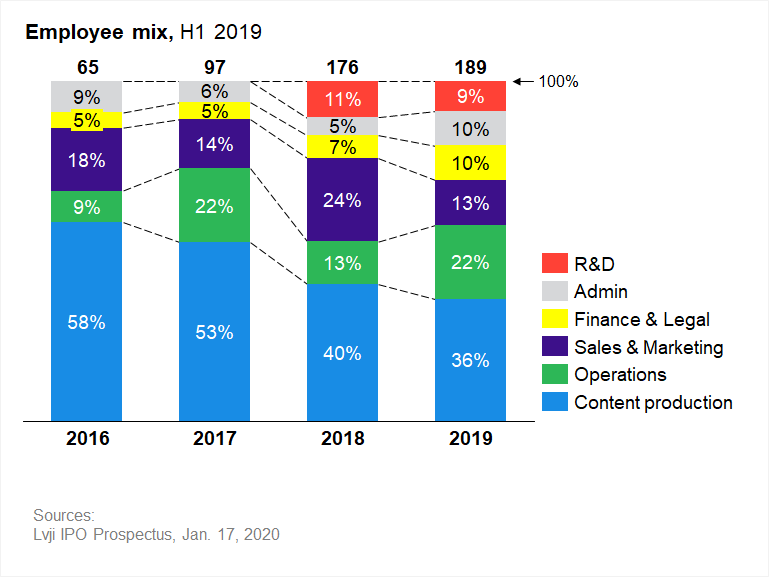

Their biggest cash outflow currently is for content production (which is their strongest IP at the moment, more than their tech imo which is a risk that will be addressed later). However, as they scale their content assets their focus appears to be shifting into R&D. This makes sense and I would have taken the same sequence of actions, and once coverage of attractions plateaus, I would lighten the content team further to a maintenance level while beefing up R&D to ward off competition. Management also stated in the IPO prospectus that they aim to grow the R&D team to 30 (from 17 in 2019). The shift is evident in the graphic below:

Lvji’s biggest cost bucket is concession fees to OTAs at~50% of sales, which still results in a pretty high gross margin, but my hope if that as they build out their brand and relationship with tourism administrations, they can eventually move to majority direct app sales and/or white label commissions with the tourist administrations, especially if the CEO can finesse some relationships with the government, which is always the invisible hand in any scaled Chinese business.

Channels — primarily OTA customers

The above-mentioned OTA channel accounts for 96% of their revenue, and while they work with 22 OTAs, their top OTA customer represented 53% of their revenue in 2018. YIKES. The good news is that they have secured exclusivity agreements with their top 2 OTAs, and looking at the below market share of OTAs, you can guess who these are.

Quick disclaimer that the above chart is for hotel bookings only; Ctrip and Meituan are fiercely competitive in the OTA space, and different sources will cite metrics in their own way to push an agenda, but they’re pretty much the BKNG and EXPE of China, and I’m relatively confident these 2 are their top 2 customers, regardless of who is actually the biggest.

The below graphic is an albeit dated but still decent map to orient yourself on industry loyalties and the strength behind these channel partners.

All this is to say, they’ve got a lock on the OTA channel — for now. Still, this high customer concentration is my largest concern and I’ll address this further below, but hopefully they also are thinking about potentially building out their direct and other channels, plus their content customization business (digital tour guide consulting) for tourism administrations.

All this resulted in the following stellar PnL for the last 4 years:

Part III: Investment merits and considerations

Here are the main investment merits:

Huge and growing domestic tourism market, with low but quickly growing penetration of online tour guides with adoption tailwind from COVID

Significant market leadership

Very low multiples

Stable growing recurring revenues, high margin, positive and growing operating cash flows

Management and investor alignment

And the main considerations:

High customer concentration

Low R&D investment

Unclear competitive intensity

Lower than expected adoption

Product commoditization

General fraud considerations for a Chinese micro-cap

Merit 1: Huge and growing potential TAM, quickly growing adoption

China’s domestic travel industry is ~5t RMB and growing at 10%+ annually riding on numerous domestic macro-trends.

For the tour guide market size, assuming only 0.1% of your trip’s cost is going towards tours (which is very conservative if you think back to how much you probably spent on tour guides / self guided tours, this is equivalent to spending $10 on tours per $10k of travel expenses), that’s still a 5b potential annual TAM. Frost and Sullivan estimates Lvji had 85% share of the vended market in 2018 with their 300m in revenues… which implies a measly 7% adoption. In reality it’s probably much lower than that given folks spend more than 0.1% of their budget on tours, so there’s even more room for growth.

Essentially, Lvji is pushing the frontier on this sector, they pretty much are the entire vended market, and adoption rate is their only constraint. It’s at the wild wild west stage of how fast can they gobble in this nascent sector.

Regarding COVID, Reuters estimates a 50% drop in domestic tourism this year due to COVID, which passes my smell test given lockdowns were February through July with a likely ramp up into stronger tourism seasonality in H2 (Golden Week). Regardless, this year’s performance really doesn’t matter much for a growth stage company like Lvji, where the vast majority of its valuation comes from the terminal cash flow, and they’re definitely still a few years out from the end of their growth runway given they’re only crushed through about 40% of the attractions in China while growing overseas.

Furthermore, an Oliver Wyman survey of 1000 Chinese travelers in April 2020 indicated 77% of respondents will take a domestic trip for their first post-COVID holiday, citing top reasons such as the virus situation being more severe overseas, desire to support the local tourism industry, and potential hostility towards Chinese nationals (sadly). 70% said they’d spend more on local experiences including tickets and entertainment programs (hi Lvji). Here’s the kicker: 65% said they will use self-guided tours more after COVID, and 71% said they’d use tour buses less.

Lastly, read this McKinsey article on post-COVID Chinese domestic tourism recovery and it should dispel any and all concerns.

Merit 2: Significant market leadership

F&S claims Lvji had 85% share in 2018. That could have been true, but I imagine it’s a little lower now. I took a quick glance at download counts and ranks, and two competitors (Sanmaoyou 三毛游 and Meijingtingting 美景听听) seem to have higher metrics. However, remember the vast majority of Lvji’s engagement is through their OTA’s apps, not their own. Also, never trust Chinese review counts… Regardless, their top competitors have received barely 10m RMB of funding to date according to Crunchbase, whereas Lvji had received 100m+ RMB prior to IPO and is now capitalized at 1.4b RMB…

First mover and market leadership in this space is important because of the nature of its entry barriers. IMO the 3 biggest keys to winning this game in this early stage, which also happen to be 3 big barriers, are:

Brand awareness with tourism administrations and OTA partners

Coverage of attractions

User experience

Lvji has all of these covered right now, and the barriers to replace the incumbent are pretty high. Consumer brand awareness is not as important since the majority of their revenue is not through a direct channel. In the longer term however, other differentiators may arise, such as technological innovation and international coverage, or if there is a shift in consumer preference towards D2C, and Lvji should position itself to tackle these in time.

Merit 3: It’s SO cheap

Remember they IPOed on January 16, 2020. This was still well into the HK protests, then COVID lockdowns began in February. Unsurprisingly their prices tanked from 2.12 HKD to lows of ~0.80 HKD and has been hovering around 0.90. What is CRAZY to me is, it’s trading at 1.15x 2019A revenues, 2–4x 2020PF revenues, 2.9x 2019A EBITDA. Find a company with margins and growth like that listed on the NASDAQ, and you bet it’d be trading at 20x revenue and -500x P/E at a $410b valuation.

Further, Chinese domestic flights are already back to 86% of last year, even though the government has imposed a 75% capacity limit at all national tourist attractions. Chinese airline stocks are already close to pre-COVID highs (though one can easily argue that Lvji’s IPO price was inflated).

Merit 4: Good growth, margins, cash flows

Income statement can be found above, here’s select cash flows. They are investing massive amounts into content production but their operating cash flows are positive and growing at a healthy pace.

Merit 5: Management and investor alignment

This one is huge. Insider ownership is high, and Mr. Zang himself owns nearly a third of outstanding shares. Public float is sorta high at 300m shares (~270m HKD and $35m), but also it’s a penny stock — daily volume hovers around 10m. I assume a few people you know could move this market…

There have been no sell-offs despite 3 lock up periods expiring (there is one last lockup of undisclosed shares expiring Jan 16, 2021) — in fact the CEO himself bought 750k shares out in the open market at 0.89 near all-time lows. Very importantly, just last week on Oct. 12 a PIPE deal went through for 48m HKD, 53m share subscription over the course of 1 week for 0.90 per share with 3 strategic individuals. The proceeds will be used for additional hiring, R&D investments, and “equity acquisition and investment of high-quality enterprises associated with the Company’s business”.

Use of funds from PIPE deal:

The net proceeds are intended to be used for (1) operating expenses of the Group such as hiring additional employees, including SaaS engineer(s), project manager(s) and sales manager(s), to enrich the Group’s human resources on SaaS segment to solidify the leading role of the Group in the technical aspect of the market, and procuring advanced hardware and software equipment to increase the Group’s productivity; and (2) equity acquisition and investment of high-quality enterprises associated with the Company’s business. The management of the Company believes that by acquiring the leading SaaS system company of smart scenic spots in the PRC, it is committed to creating an enterprise level service ecosystem of “hardware + software + service”, and providing customers with efficient, convenient and low-cost SaaS services in cloud smart scenic spots, in consideration of the great market space of the Group’s large-scale tourism and ecological development model.

Overall it appears to me that management and investors are very aligned and so far there is no sign of weakness or fear of lasting COVID impact.

Consideration 1: High customer concentration

This is my largest concern. If either Meituan or Ctrip drops them that’s a HUGE problem. Meituan appears to be more aligned since Tencent (a major investor in Meituan) has also partnered with Lvji directly for a “tourism digital transformation” project in Yunnan, according to their interim report from October 2020. Regardless I’d like to see clarity in their strategy to stay sticky with these 2. They have exclusivity agreements with both of them but that doesn’t mean they can’t drop Lvji altogether or create their own version, especially if this is just white-labeled currently and consumers have no brand awareness of Lvji itself.

Consideration 2: Low R&D investment

Two parts. One is related to the above, the tech itself is not difficult to replicate, and a channel partner/customer like Meituan or general tech giant like Tencent could quite easily do this themselves. As mentioned above Lvji doesn’t have a strong direct consumer brand (yet), so I think Lvji’s direct relationships with tourist administrations are critical to prevent a copycat, and I hope they continue to inject themselves directly into the tourist administration ecosystem with their digital consulting business. This erects a higher barrier protecting the tech copycat threat (which I would currently consider a weak point given their low investment in R&D staff and dollars). Additionally if they solidify these relationships and become essentially the gatekeeper for digital tour guides in China, they could fend off competitors while shaping up to become a M&A target for the Meituan / Tencent gang, rather than getting squashed.

The second risk is tech innovation from direct competitors. While their afore-mentioned two “largest” competitors don’t appear to be legitimate threats at the moment, I’ve taken a cursory survey of their websites, teams, reviews, product features and honestly everything looks more set up for success. Again, this could just be good marketing and I’d have to test out the actual product or do a consumer survey to find out for sure, but at the surface level it does appear there is a much stronger focus on innovative tech (e.g. AR, VR, IoT) by their newer competitors, better app reviews (D2C is not Lvji’s bread and butter), and strong R&D employees.

The good news is they stated in their annual report that they plan to use 10% of IPO proceeds to improve R&D, and plan to increase their R&D team from 17 to 30. At least it’s on their radar.

Consideration 3: Unclear competitive intensity

Related to the previous point, since Lvji is the only public company in this space, it is unclear what the competitive landscape truly looks like. They also seem to have the OTA channel locked down, but what if the consumer preference is for a direct model? Hard to say without consumer surveys, channel checks, and further due diligence.

Consideration 4: Lower than expected adoption

I think this one is unlikely, but there is the chance that online tour guide adoption just doesn’t pick up in China. I have modeled the number of rated attractions that Lvji covers using the same growth rate from 2018–2020:

80/20 rule applies here; 5A attractions are the best ones like the Great Wall and though they are the fewest, 5A along with 4A attractions generate generate the vast majority of revenue for Lvji:

Lvji has effectively 100% of the 5A attractions covered, as they should and have stated will continue to maintain, plus a majority and growing % of the 4A attractions covered.

What I gather from the above 2 charts is that they have “laid out all the traps” and just need tourists to start continue adopting the technology. Judging from the increasing trend of their average revenue per guide per attraction, I think it’s safe to assume adoption should continue to increase in tandem with their increased coverage:

Consideration 5: Product commoditization

I’m slightly concerned that their product, especially being white-labeled and having low consumer brand recognition, could eventually become commoditized. I used their ‘16-’18 units sold vs. average price to put together this demand curve, and it’s basically a straight line with R-square = 0.99. This made modeling pretty straightforward but operationally it means that price is a very strong lever for volume, and the straight line shape of this demand curve gives me mild concern that competition can easily drive prices down for everyone (a convex curve would imply there is an “intangible value” to their product that is more shielded from price competition). This also insinuates that at the current service level, they will not be able to sell more than ~18,000 units a year per guide, which is fine (for now) as my projection years max out at 9000 or so units per guide per year, but that’s pretty much the ceiling if they don’t improve their product. For the econ nerds, this implies they gotta amp up their product and R&D in order to can sell marginally more units at all price levels (shifting and bulging this curve outwards to the right and up).

Consideration 6: Fraud risks of a Chinese micro-cap:

This one is my favorite. Yes, it’s a Chinese micro-cap and comes with its requisite risks. For example, I believe this Muddywater report on GSX is spot on and GSX is a Luckin Coffee-tier fraud. There is the chance that Lvji is also a complete fraud, and all their numbers are fudged. A few points have been brought up as potential red flags in my discussions on the topic:

They do not disclose units sold or ASP in their 2019 annual report released in March nor or the 2020 H1 interim report released in September despite touting these numbers in the IPO prospectus in January. This could be a means to cover up massive growth slow-down, which the 2019 interim reports vaguely seems to hint towards.

No clarity on the how the founder and his partners came up with 10m RMB (1.5m USD) and did not require financing in the years prior to profitability in 2016 — but I don’t think this is an incredulously large amount that warrants fraud accusations.

Low price of the IPO (3b HKD valuation) given the stellar financials in the prospectus, and CCB as the underwriter (their chairman was jailed for 15 years in 2005 for bribery and other nonsense); I am slightly suspicious of the intentions for an IPO of such a supposedly fast growing company.

Listing offshore in Hong Kong instead of in Shen Zhen with a potentially higher valuation — I believe this could be for access to international individual investors, but also seems a little fishy.

None of our Chinese contacts are aware of this app — possible explanation is that firstly the technology is white-labeled and embedded in their OTA partners’ apps so their own Lvji brand is never shown directly to consumers except for the 1% of revenues that come from direct app purchases, and secondly this is targeted towards middle income families in China, with which I doubt many sophisticated western investors have contact. The third case is that their usage numbers are fraudulent.

I’ve personally downloaded the mini-app on WeChat to test it out, and boy do I have to say it is far from the best app I’ve used. Unless I’m using it incorrectly, they must have a magical sales and marketing team in China.

I’m also pretty sure a majority of their app reviews are fake, but that’s par for the course for many legitimate Chinese companies (and many U.S. ones too…). The mispricing reward is incredibly asymmetric if you go off the assumption that this company is not a fraud, but regardless DYODD and use judgment! It very well could be.

Part IV: Financial valuation and risk

Methodology and assumptions

My general methodology and base case assumptions are as follows:

Average of 2 revenue build approaches: a top down coverage approach, and a bottom up content production approach (see details above)

I use base case growth assumptions derived from historical ‘16A–’19A

Cost drivers (most prominently OTA concession fees) as % of revenue and expense drivers per employee or revenue

Mostly straight-forward Balance Sheet and Cash Flow drivers, except with CapEx based on per additional guide produced, and Amortization based on historical % of Intangible Content Assets

Resulting UFCF is plugged into DCF. WACC is estimated using CAPM (Beta is regression vs. HSI Index = 1.21, Market risk is the 33-year CAGR of HSI = 9.2%, Risk-free rate for 2020 and 2021 is the 10 year Hong Kong Bond yield = 0.5%, and 2022+ is the average of the past economic cycle ~1.6% given JPow plans to keep U.S. interest low until at least 2022

Perpetual growth rate for terminal value is 3% (FYI China’s GDP growth has been 6–15% since 1990)

NPV of all cash flows + Net Cash position in June 2020 = Equity value in RMB, divided by shares outstanding and converted to HKD per share, assuming no options

Share price sensitized against 4 proxy scenario groups representing the considerations mentioned above i.e. growth outlook, adoption outlook, competitive intensity, OTA coverage

~400 scenarios for share price plotted on frequency distribution, and compared against peer multiple valuations and analyst estimates

Notes:

Growth runway (last year before terminal cash flow) is set to 2025 base case when attraction coverage is forecasted to plateau, and is sensitized

I manually estimated a conservative 2020PF P&L that replaced the 2020 calcs but assumed 2021+ grows with the pre-COVID assumptions on 2020PF COVID numbers

Pictured below if you’re inclined to read through; btw if you want this file lmk I can email you the original xls.

So you’ll see on the sensitivity tables in green that the base case is exactly 3.00 HKD I swear this was not contrived. Anyway, here’s an explanation on these scenarios:

China growth outlook: this sensitizes the growth runway, which is the trigger year for price increases, content production slowdown etc., against perpetual growth rate (GDP growth)

Industry penetration outlook: sensitizes growth runway with the slowdown in revenue per guide growth, which I am using as a proxy for penetration/adoption of digital tour guides

Competitive intensity: sensitizing R&D cost increase against adoption as a proxy for increasing competition leading to fighting on the R&D front and churn

OTA concentration: for the reasons mentioned above in consideration #1, I don’t think their top 2 OTAs backing out is likely and if that happened this whole ship would probably get gutted, but I tried to simulate smaller OTAs (they have 20 other partners) backing out by significantly slowing down growth for both the # of attractions covered and revenue per guide. In reality a top OTA backing out would be disastrous so I sure hope it doesn’t happen.

Comp valuations as a reference point based on 2019A revenues, EBITDA, and 2020 H1 revenues below:

Also useful to note these companies are all huge (except SEHK:780) and have MUCH lower growth, and some of ’em still don’t have as strong margins as Lvji

In step 8 outlined above, I dropped all these 396 prices onto a frequency chart like a quasi-Monte-Carlo, which I have superimposed on Lvji’s stock chart below with a few other annotated valuations and reference price points:

Above you’ll find Lvji’s price chart in black, the distribution of the 4 sensitivity results on the left in blue (that big blue bar up top is the overflow bucket for frequency of all prices above 4 HKD), and a couple price annotations on the right. Basically, the red and green annotations and even the price chart itself all corroborate the distribution in blue, in that the current 0.90 ish price point is pretty much the floor, that the CEO went out to buy shares in the market at 0.89, and 3 high-net-worth and strategic investors put in 48m HKD at 0.90 per share.

Additionally the two comp valuations in black corroborate the central peak of the blue distribution, and I expect the intrinsic value of Lvji to be somewhere in the mid-2 HKD range. This coincides with the only 2 analyst estimates currently out there (in blue font), which are 2.50 HKD from China Construction Bank (CCB) — a big 4 bank in China, and 2.20 HKD from Bank of China, a 6% shareholding insider and pre-IPO investor that is majority state-owned. I feel more comfortable with talking about target price with probabilities rather than discrete numbers, and Lvji has no options but if they did, price probability distributions also help significantly in optimizing risk/return.

Based on the above analysis, I am targeting 2.50 HKD (2.8x return)

This is another way to look at it, the probability of Lvji being worth above 2.50 HKD is ~67%, and probability of it being worth less than the current 0.90 is ~0.5% — a very asymmetric setup.

Part V: Counterfactuals and wrap up

Of course this could be massively wrong and the probability curve could shift dramatically one way or the other, but at least from how this shook out I’m pretty confident any price discovery we see from catalysts is much more likely to be upwards than downwards. I’m mostly concerned about any catalyst happening to move the price at all, hence why I am publishing this. The biggest catalyst would simply be better coverage, as I think this is simply an orphaned IPO gem that is flying under the radar. The PIPE deal should give this some credibility, and continued release of improving domestic travel data plus their 2020 annual report or interim guidance on H2 results could instigate further price discovery.

Here are some counter scenarios that could spell trouble:

One or both of their top OTAs drop them or develop a copycat

A competitor IPOs or releases data that shows they are making way more money than Lvji or are growing way faster

Lvji is a fraud for the reasons mentioned in consideration #6

COVID cripples the Chinese domestic tourism industry for years to come and massively decreases spending

The gen pop hates this concept and prefers human tour guides, the official self-guided tour, or a competitor’s product, and their growth so far has just been eager early adopters

These are certainly possible though I would tag most of them as being quite unlikely. If I had the access, my next steps in diligence would involve channel checks with their OTAs, surveying consumers for preferences, digging into the competitive landscape, testing the apps, expert calls with tourist administrators, and financial diligence on Lvji’s numbers.

Overall, if this is a fraud then oh well, guess I fell for it. But if it isn’t, I find it hard to believe it won’t pop.

That’s all, thanks for reading and let me know your thoughts!

Please contact me if you’d like to re-use any of the original research or the files I used, I’d be happy to get in touch.

Disclaimer: At time of writing I have no position in LVJI.

The above references my opinion and is for information purposes only. I am not being compensated by any company or persons mentioned in this article. The opinions stated here do not represent my employer’s opinions. All information used is publicly available and assumed to be factual. This is not intended to be investment advice. Investing in unregulated securities bears extremely high risk.

GQ, just found your substack. Awesome writeup! I have a 1% position in LVJI, because the growth and valuation are too good to pass up, but it seems too good to be true (which makes it seem like it could just be a fraud).

Have you heard of IHuman (IH)? They seem like they are in a similar situation as LVJI. 200% growth, subscription revenue, insanely cheap valuation, looks too good to be true. Dont know what to make of these Chinese too good to be true stocks.

Hi, thanks for the write-up. I hope you don't mind me asking - if the risk-reward is that compelling, is there any other reason why you do not have any position in LVJI?

A small position size of 2-3% makes sense even if you are really concerned with general fraud risk and the company's corporate governance in China. The HK market is extremely inefficient, the market left LVJI orphaned after the broken IPO during the peak of COVID last year in China - rather than due to a risk of fraud. I do expect them to handily beat the market's depressed expectations next earnings call due to last year's low base rate.

I find it highly unlikely (but of course, not impossible) that the founder-management would risk his substantial net worth for fraud. They also have government-backed funds as one of their substantial shareholders - not sure if this matters.

Thank you for the write-up!

Josh