Update on HRBR Liquidation!

We finally have something to work with here

So it was a liquidation after all…

The valuation of Harbor Diversified (HRBR) following its December 18, 2025, divestiture announcement is a classic exercise in SOTP liquidation. By offloading AWAC and its Bombardier fleet for $113.2 million, and combining the last balance sheet from September 2024, we’re doing some forensic accounting on how much “leakage” has occurred during this 15-month reporting gap and the costs of a operational wind-down.

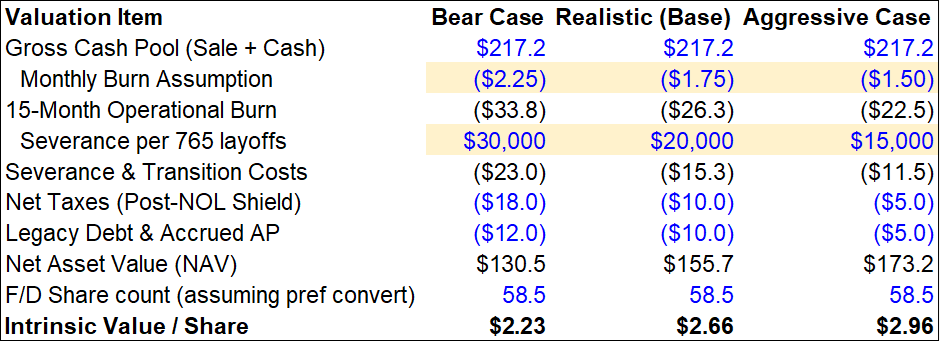

The table below outlines the range of scenarios:

*slight correction from last version, the 58.5M share count is accurate post conversion, I hadn’t realized the pref was already converted to common so that makes it even easier/better.

The 15-Month Operational Burn is calculated from October 2024 to December 2025. In the Bear Case, I assume a monthly burn of $2.25M which was the last reported. The Realistic Case scales this to $1.75M/month, which aligns with a carrier that has significantly reduced its flight schedule but still maintains a Part 121 certificate to facilitate the sale.

The Severance & Transition assumptions are driven by the 765 layoffs reported in WARN notices throughout 2025. It is critical to note that “accrued payroll” on the last balance sheet typically only covers wages already earned, it does not pre-fund future severance triggered by a divestiture. The Bear Case models an aggressive $30,000 per head average payout, reflecting high-seniority pilot union (ALPA) demands. The Realistic Case assumes a more standard transition package averaging $20,000 per head, noting that many junior staff and flight attendants likely had lower contractual protections.

The NOL that started this whole thing is ironically still the most significant hidden gem. I’d estimate HRBR is carrying roughly $55 million in Net Operating Losses (NOLs) by now given the last few quarters of low operation. In the Realistic Case, the NOLs shield approximately half of the sale gain, leaving a $10M tax bill. The Bull Case assumes management successfully “engineers” the sale to utilize the full NOL carryforward.

Finally, the Debt and AP lines assumes the retirement of the remaining $12M in senior debt and the settlement of trade payables. If management confirms a path to a special dividend at the upcoming December 30 Annual Meeting, the discount to value should evaporate, and the stock will likely gravitate toward the top end of my range.

Conclusion

At the current market price of $1.24, you are buying the stock at a discount to even the most conservative “Bear Case.” At this price either this name is too illiquid to reflect value (which it is) or the market is saying that management will either fail to close the deal or “waste” the cash on a new, unproven business. If the December 30 Annual Meeting clarifies a path to a special dividend, the stock should move toward the $1.90 target as the uncertainty fades.

Unfortunately it’s difficult for retail investors to buy now so only the more institutional folks are buying at these prices, but best of luck and hope there’s some kind of dividend coming soon! Great update.

Disclaimer: At the time of writing I am long HRBR.

The above references my opinion and is for information purposes only. I am not being compensated by any company or persons mentioned in this article. The opinions stated here do not represent my employer’s opinions. All information used is publicly available or reasonably obtainable and assumed to be factual. This is not intended to be investment advice. Investing in unregulated securities bears extremely high risk.

Isn't there likely more value in the remaining planes they own?

Share count is actually a huge correction, your PT's moved significantly. Appreciate the update either way but I think it warrants an email.