$HRBR: market has priced Air Wisconsin for liquidation--why that's a major mistake

Following United's announcement of an upgauging strategy, the market has priced in a swift liquidation for Air Wisconsin. Evidence suggests the opposite will happen, creating a 270% upside opportunity

8/13/21 Q2 Earnings Update

Solid earnings overall, the main takeaway for me is that going concern post 2023 is almost a certainty, so I’ve increased my expected probabilities for scenarios 3 and 4. Here’s what I liked and didn’t like:

Highlights:

Expansion plans

Management has confirmed my scuttlebutt that they’re looking to up-gauge and even modify (?) their fleet. The new CRJ 700 and 900 were expected and a nice confirmation, but I was pleasantly surprised to see they are thinking of converting the CRJ-200s for freight; didn’t even think of this angle but this could be significant. HRBR’s 200s are old (18 years avg) but keep in mind that they got much fewer cycles during COVID so it’s effectively probably ~17 years. In addition, Skywest’s oldest jet is ~24 years so there’s plenty of life left. In addition, freight airplanes require much less maintenance capex than passenger jets, so freight is potentially a highly lucrative call option for HRBR.

Most importantly I’m glad that (1) management is showing their sophistication and innovation (2) management is not shying away from disclosing such things, as they historically have.

Buybacks

Secondly, we finally got buybacks! About $900k (vs. the maximum of $3m) so not game-changing nor insanely bullish, but it’s definitely a good sign. Also, note that average price in May was $1.73, and May traded up to $2, implying that somewhere ~$1.9 is a very very strong price floor, for downside protection.

Solid capital allocation

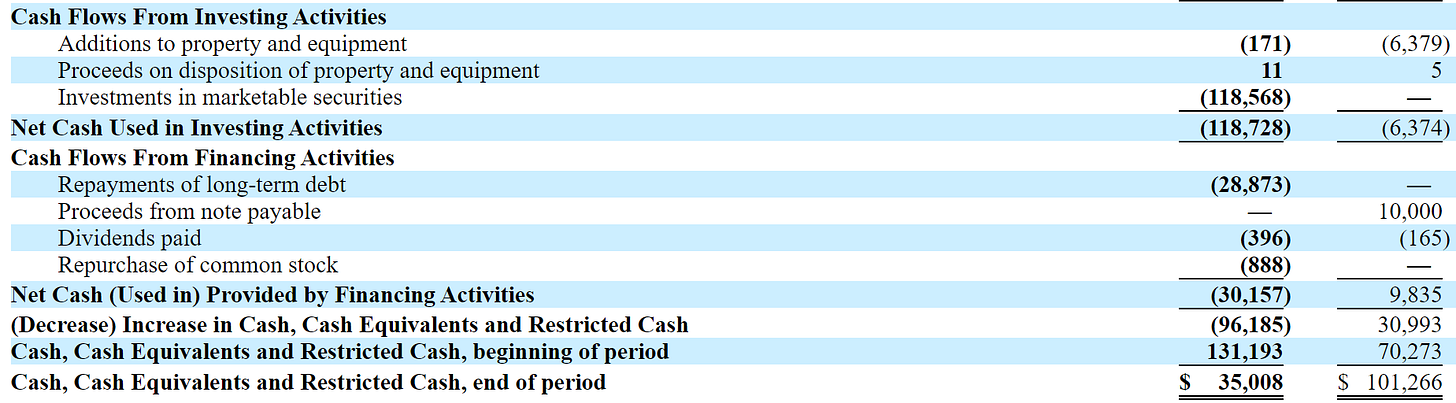

HRBR had a ton of cash so they paid down $29m of debt, repoed $900k of stock, and invested $118m in H1 into marketable securities—assuming it’s some sort of treasury product since that only generated $43k of income, implying at least 1.6% annualized yield if they dumped all that in on April 1.

Considerations:

Operating Metrics

The primary consideration is that revenue (and EBITDA) have not recovered as expected. However, I’m not concerned about this since this is primarily due to their accounting; they need to follow ASC 606 and recognize revenue at delivery, but since the CPA is contract revenue United pays them cash regardless. So while revenue (and EBITDA) are a little stunted, the cashflow is still accumulating in contract liabilities and deferred revenue. These will likely get recognized in the 10K at 2021 year end (check 2020’s Q4 and you’ll see that massive spike in recognized revenue and earnings for Q4), and worst case in 2022 or 2023+, so if you believe they continue after 2023 (which I do), then this should not be an issue.

Overall pretty positive earnings signaling to me management cares and has a plan. That’s about as good as it gets with this management.

7/8/21 Original HRBR Thesis #2

Summary

Following a announcement from United Airlines on June 29th regarding sunsetting their fleet of 50-seat single cabin regional jets by 2026, the markets have taken an unreasonably pessimistic view that Air Wisconsin will be on the chopping block at its next contract renewal in February 2023.

First of all, currently at $2.10, HRBR is priced BELOW even liquidation value of $2.17. Any continued operation beyond 2023 would increase HRBR’s value by at least 30-40%, and any transformative transaction would increase its value by multiple times, to $6-$10+.

This article presents overwhelming evidence suggesting a liquidation is NOT happening, and in fact the opposite is likelier—a transformed and upgraded fleet for a going concern operation way beyond 2026.

At $2.10, HRBR is essentially a risk free call option through March 2023, and only begins to bear any sort of risk after April 2022. A risk adjusted valuation of $5.65 results in 270% expected upside with potential for much more, with very limited downside.

Background

The background for this opportunity is just as fascinating as the opportunity itself. I strongly encourage all to read this previous article which explains in detail the HRBR situation up through June 29, 2021 when this new opportunity presented itself. Here’s a quick summary and timeline:

$HRBR is now the holding company for Air Wisconsin after some interesting restructuring. Air Wisconsin now operates a fleet of 64 CRJ-200s (really old 50 seater planes on connection routes) exclusively for United Airlines through United Express through their hubs in ORD and IAD, along with some other regional airlines including Skywest, Mesa, GoJet, Commutair, Republic.

In 2019 Air Wisconsin cleared $260m of revenue, ~$60m of EBITDAR, ~$40m of UFCF.

Pre 2011: HRBR was a failing bio-tech

2012: bought out for its NOLs and became the holdco for Air Wisconsin

2012 - 2020: HRBR went dark for 8 years until a shareholder sued to release filings in 2020

July 10, 2020: HRBR posts its first 10K in almost a decade, posting $260m revenue while trading at ~$10m market cap because no one knew wtf this company was.

Dec 26, 2020: Released research describing the ludicrous opportunity at ~$0.29, with price target of $3.60 to $4.

June 29, 2021: $HRBR increased about 10x within 6 months, peaking at $3.10 on the day prior until UAL, exclusive contractor of Air Wisconsin, announced its new 2026 strategy to upgauge the fleet (increase seating), including phasing out 50 seaters (note that all of Air Wisconsin’s fleet are 50 seaters). Price tanked 45%.

The Opportunity

$HRBR is currently priced below liquidation at ~$2.10, but compelling evidence suggests a liquidation is unlikely to happen anytime soon, and on the contrary Air Wisconsin plans to expand, creating tremendous upside potential from current price

We’ll go into valuation in the following section but currently at $2.10, the market is pricing in a 2023 liquidation, likely based on the recent UAL news, but I believe the market completely misunderstood the UAL news.

United’s 2026 Strategy

The 2026 United Next strategy from UAL released on June 29, 2021 describes UAL’s 5 year strategy. Apart from operational improvements, the main strategic growth drivers are:

Upgauging the fleet by ordering 270 narrowbody jets for its mainline fleet and retiring 200+ single-cabin 50 seat regional jets by 2026 (slide 13).

Strengthening hubs, particularly the midcontinental hubs (slide 15-16).

HRBR Price Reaction

When I first saw this news on the morning of June 29, frankly my first thought was—great, United thinks post-COVID travel will explode, and they are adjusting their strategy to capture the upside, plus they’re upgrading their fleet particularly in the mid-continental hubs where Air Wisconsin focuses: great news for United and Air Wisconsin (HRBR).

Yes, it did cross my mind that Air Wisconsin’s fleet of CRJ-200s were exactly the type of single-cabin 50 seaters on the chopping block, but this is a 2026 strategy and I figured they had plenty of time to slowly phase out the old fleet for an upgraded one.

However, a quick look at $HRBR’s recent price chart shows the market clearly thought differently, posting a hideous ~50% drawdown in 2 days. My speculation on the trading psychology which created this opportunity:

Market participants saw the 2023 UAX contract renewal date, assumed Air Wisconsin’s CRJ-200 fleet was on the chopping block, put 2 and 2 together and concluded (prematurely) that United would not renew their contract with Air Wisconsin come February 2023, and HRBR would have to liquidate in 2 years.

Price begets narrative, and market participants saw the reaction from the market as confirmation of their fears, and either did not research or did not do it quickly enough to realize the fears were unfounded on fact, and sold.

Some minor selling led to more selling, and it happened so quickly that many uninformed investors panic sold on the news, or were auto-stopped out.

This was made worse by the massive run-up leading to the UAL news, with many short term traders looking to stay in the green, and “longer term” investors looking to lock in profits on a monumental 10x run within 6 months.

Market participants capitulated throughout the course of the week that perhaps this was an overreaction, and came back buying in force, driving price from lows of $1.6 to an intra-day high of $2.28 in just one and a half days.

So, what is the right price?

It is difficult to pin the “right” price per se. I have outlined 4 of the most likely scenarios below and their respective valuations and my take on probabilities of occurrence. You can tweak these on your own to come up with your risk-adjusted valuation.

Based on the evidence, I think the base and upside case are most likely, which projects a risk-adjusted value of $5.65 per share for 270% upside from $2.10.

Naturally, the upside case is imprecise; all I know for sure is, directionally, the liquidation case is extremely unlikely to happen, so buying at the current prices means the downside is extremely limited while the upside could be extremely high.

Scenarios and Valuations

These are the 4 most likely scenarios. These of course aren’t exhaustive but whatever happens to Air Wisconsin should smell like one of these. I’ve done a valuation for each case and assigned what I think is the probability of a similar scenario playing out. The valuation for the liquidation and conservative cases are obviously conservative and more precise. Naturally the upside cases are more imprecise and I am only using them as directional guidance.

To summarize:

Liquidation Case: 2023 Liquidation ($2.17, 5% probability)

Conservative Case: Wind Down for 2026 Liquidation ($2.77, 35%)

Upside Case A: Up-gauge fleet gradually through leases (~$6, 40%)

Upside Case B: Up-gauge fleet rapidly through M&A (~$10, 20%)

Using these probabilities, I arrive at a risk-adjusted valuation of ~$5.65, which is my new price target.

Let’s dive in to each scenario:

#1 Liquidation Case : 2023 Liquidation ($2.17, 5% chance)

The liquidation case describes United Airlines opting NOT to renew their contract with Air Wisconsin in Feb 2023, AND Air Wisconsin not being able to find another carrier to contract with, AND as a result Air Wisconsin liquidating the business in ‘23.

In this scenario, HRBR is worth $2.17 today.

I’ve taken a NAV approach, plus a mini DCF on the 2 remaining years of normalized UFCF of $44m each, plus the liquidation proceeds of the 64 CRJ-200 jets.

However, overwhelming evidence suggests that Air Wisconsin will not liquidate in 2023.

I hope the following series of evidence dispels ANY consideration that the liquidation case is even remotely likely.

Let’s examine:

Check out this Air Wisconsin job posting from May 27, 2021. It clearly states they already have a new CRJ-700 jet on deck, and will have a CRJ-900 in 2022. An airline going into liquidation in 2 years would not add 2 larger jets to its fleet.

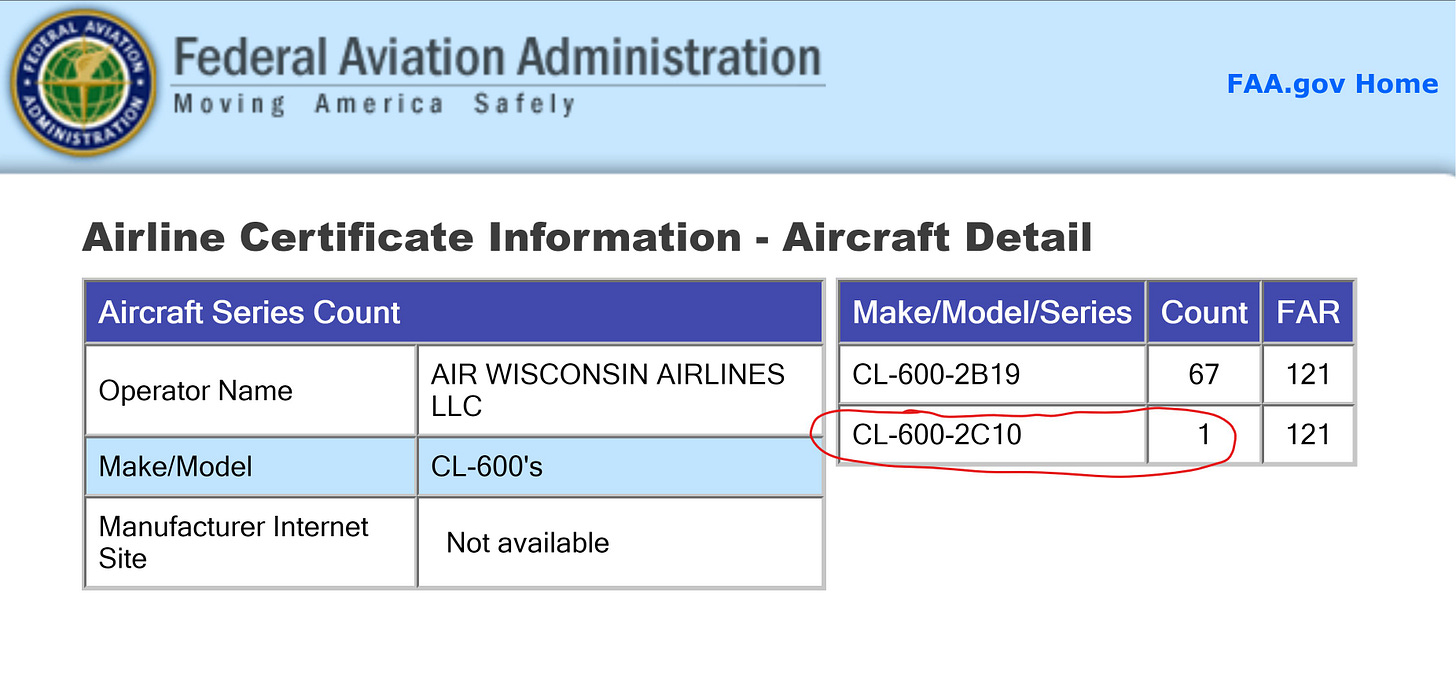

Indeed, Air Wisconsin’s FAA certificate includes a CL-600-2C10 (manufacturer’s name for CRJ-700). Again, an airline wouldn’t randomly get a new class of airplanes certified if it wasn’t planning to do something with it. And if Air Wisconsin starts flying CRJ-700s, you can bet it’s not getting axed by United for years to come.

The CRJ-700 is actually leased from Elite Airways, as seen on their Wikipedia page.

In fact, active airline forums have spotted this very airplane at an Air Wisconsin hangar, so yes it is without a doubt, real.

I have spoken with a current pilot who is certified to fly 200/700/900; he confirmed the scuttlebutt above regarding new 700 and 900 jets. He also noted, helpfully, that since the 3 CRJ classes are very similar, the cost and time required to re-skill pilots is minimal. Again, this implies the upguage from 200s to 700/900s is perfectly possible for Air Wisconsin.

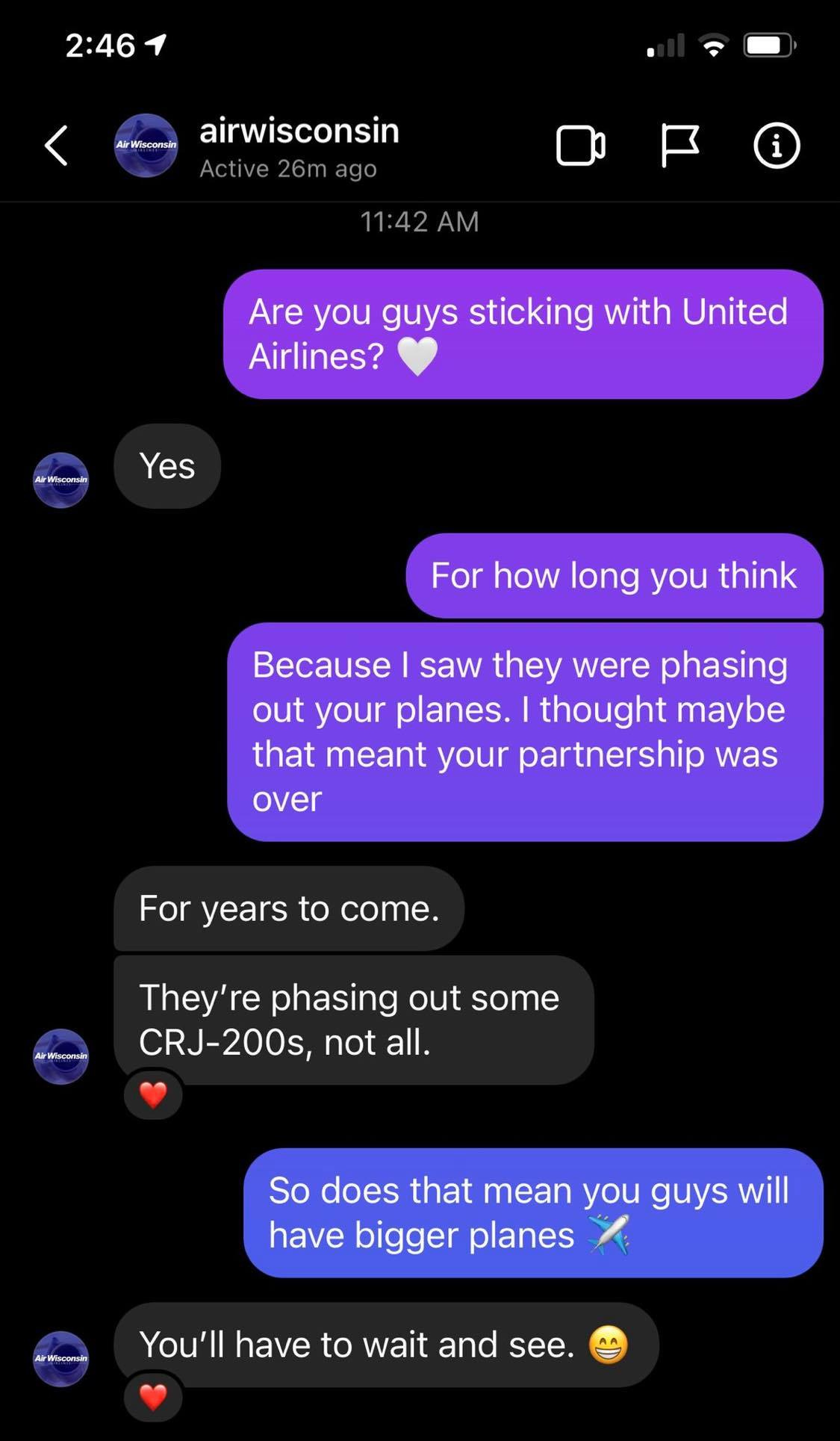

Another pilot confirming:

And even Air Wisconsin’s twitter page jumping in:

Air Wisconsin is massively increasing its pilot and first officer hiring. Why would a liquidating company need 2 new hire classes every month through the rest of the year? And keep in mind, they had furloughed pilots for COVID, not laid off, so their return is not double counted here.

Another critical piece of evidence is Air Wisconsin’s new CFO. They hired Liam Mackay in January of 2021. Previously, he was Director of United Express Regional Commercial Strategy at United Airlines, aka he had the pulse on future strategy for United Express contractors like Air Wisconsin. He 100% knew about this “UAL Next” strategy before it became public, and yet still chose to uproot his family and life in Chicago, and (no offense) take up this job at a small regional airline in Appleton, Wisconsin.

According to the 10K, he is being paid $220k with a 50% target bonus. This is average for a company of this size and an executive of his tenure, which provides me with very high comfort in Air Wisconsin’s future as a going concern—it is basically impossible that this guy chose THIS job if he knew it was going bye-bye in 2 years.In addition, HRBR has a dividend policy that starts PIKing in 2024. I mean, there’s no dividend to PIK if there’s no Air Wisconsin left by then, so again, liquidation in 2023 is moot.

Perhaps most compelling (but a little convoluted so bear with me), is how the different UAX fleets add up according to UAL’s new strategy. Following the math below, it is impossible for Air Wisconsin to be cut completely, as there would be no one left to cover O’Hare (ORD), which is not only an important hub for Air Wisconsin, but more importantly a mid-continental hub, which is a key hub of focus under United’s new plan.

This is what the UAX regional fleet looks like, per the latest 10Q’s from each public company, and other sources for private peers.According to UAL, Newark (EWR) will see its entire 50 seat single cabin fleet phased out by 2021 year end. This critical tidbit is not on the deck but is voiced over by CEO Scott Kirby around the 31:00 mark on the webcast here. This means CommutAir is gone, since the CRJ-550s in GoJet’s fleet are triple cabin. CRJ 550s are 70-seater CRJ-700s modified into triple cabin 50-seaters to increase RASM (revenue per available seat mile) with First and E+ seats. United has explicitly called out they will keep the 550s in EWR and ORD on slide 19 (important again later).

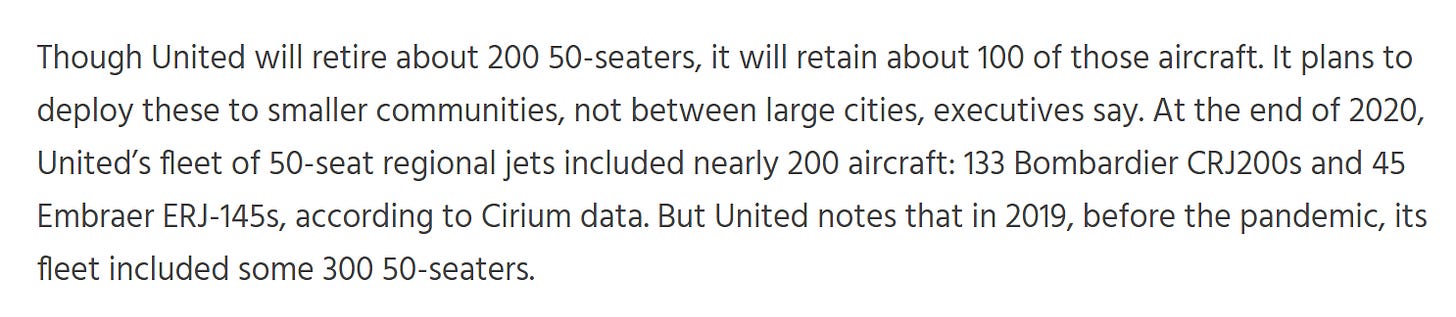

This leaves Air Wisconsin and Skywest’s CRJ-200s. Well, here’s the thing, on slide 13, Kirby says they’re “cutting 200+ single cabin 50-seaters”. That means some or all of Skywest’s fleet has to go, since if you only cut CommutAir’s 132 and Air Wisconsin’s 65, that doesn’t get you to 200. But if you cut all 3, then 132 + 65 + 108 gets you to 305, in which case Kirby would have said 300+ instead of 200+. Therefore, Skywest and Air Wisconsin will both get a reduced capacity BY 2026. You can back into these numbers again with a different source here—there will be 100 CRJ-200s left…In addition, on the same slide, United says it will keep 4% of single cabin 50-seaters servicing ORD. That is a pretty small number, and since Air Wisconsin has a lower cost to United than Skywest, it would make more sense for Air Wisconsin to get this contract. Regardless, this describes the 2026 end-state and has NO bearing on what happens between 2023 - 2026.

I hope it is clear now why it makes NO sense for United to immediately cut Air Wisconsin in 2023.

I included this case not because I think it is likely, but only to set a floor for the downside. Basically, HRBR should not be worth less than ~$2.17 unless something drastic changes.

#2 Conservative Case: Wind Down for 2026 Liquidation ($2.77, 35%)

Based on the same facts as above, I think the much more reasonable conservative assumption is to think Air Wisconsin survives the 2023 renewal, but begins to wind down its capacity with United through 2026, until it is liquidated or equivalent.

In this case, I estimate HRBR to be worth ~$2.77; the valuation is very similar to the first case, using a NAV approach plus a mini DCF that stretches out to 2026 with reduced capacity post 2023, plus liquidation proceeds from the jets. This yields a VERY cheap 3.1x EBITDAR.

Even if you take the most conservative assumption that there is 0 liquidation or even metal scrap value, this case still yields ~$2.50.

While this is much more likely than the first scenario, I still think it is not the most likely case.

Mackay’s perspective

Think again from Liam Mackay’s perspective: would he leave his quickly progressing UAL career and move from Chicago to rural Wisconsin to join a lower-tier company just to start winding it down in 2 years? This guy is 36, I highly doubt he’s gung ho about a job description that says: sunset this company in 2 years and kill it in 5…

What’s more likely, given his role at UAL, was that he LITERALLY created the strategy for UAX and perhaps even specifically for Air Wisconsin, and he realized how much upside there was to be had, and decided to give up his life in Chicago to go after a career-defining move.

Board perspective

In addition, I keep coming back to this board. Keep in mind their board is extremely sophisticated; all 3 of them are ivy-league or Canadian equivalent PE/IB veterans. They aren’t just some legacy airline operators—they bought the HRBR shell back in 2011 for one reason—to turn a profit. Richard Bartlett, beneficiary of controlling entities Amun and Southshore, is literally an Air Wisconsin lifer and has been with the company through ups and downs for decades. Is he suddenly going to let it go now? Post COVID? When everyone and their mother is trying to revenge travel? I doubt it.

In sum, while this scenario is much more likely than a liquidation in 2023, I still think it is not the most likely. Trust me, Bartlett ACTIVELY hates minority shareholders like us (they have not returned a single email or call), but this would be a failure even in self-dealing if the board simply lets this company fade into liquidation after decades of operation. And CFO Liam Mackay would have made a massive career mistake.

#3 Upside Case A: Up-gauge fleet gradually through leases (~$6, 40%)

I think the most likely case is either of the 2 upside cases, as in Air Wisconsin continues operating as a going concern. The only difference between these 2 upside cases are whether Air Wisconsin leases or acquires their upgraded fleet through M&A.

These two valuations are more imprecise and directional, since the out years get fuzzy, but using a full DCF, I’m projecting ~$6 value (~6x EBITDAR) if Air Wisconsin gradually upgauges its owned CRJ-200 fleet 1:1 into leased 700 and 900s.

Basically, if there’s any type of transaction at all, the terminal cashflow will massively increase NPV beyond the $2.17 liquidation value to at least $6-$10

This process could take many forms, in different combinations of fleet classes, so $6 is definitely only a directional guide.

The driving assumptions are:

An increase in contracted revenue per available seat miles (CRASM) due to premium mix shift (which is what UAL Next is all about really)

A 1:1 gradual fleet replacement with leases

Run rate OpEx based on revenue drivers

Maintenance CapEx and Leases comped from MESA, which is an exclusively 70 seater fleet

Thinking again from Liam Mackay and the Board’s perspective, this scenario seems the most likely to me. If you were Mackay, drafting up this UAX strategy, and Bartlett calls your phone one day, “hey, if you guys are gonna upgrade the whole fleet but you still need 50-seaters at O’Hare, why don’t you come run the transition into a new fleet here at Air Wisconsin?”

Maybe it’s just me, but this would be interesting enough for me to give up a steady life and career in Chicago to try something like this with Air Wisconsin (I’d definitely say NO if instead I were to sunset this company in 5 years…)

#4 Upside Case B: Up-gauge fleet rapidly through M&A (~$10, 20%)

An alternative flavor to the previous upside case is instead of leasing the new fleet, Air Wisconsin undergoes some sort of M&A to acquire a better fleet. The most ideal and likely M&A target would be GoJet.

GoJet

GoJet currently has a fleet of 47 CRJ-550s (converted 700s). It signed a capacity purchase agreement (CPA) in 2019 with United, to supply 75 premium CRJ-550s for the next 10 years, which would have been awesome if COVID didn’t happen. GoJet (private) is held by parent company Trans State Holdings (TSH). Pre-COVID, Trans State Holdings also held two sister companies of GoJet called Compass and Trans State Airlines.

Cue COVID and the unwinding of TSH (and I’m speculating, the end of GoJet too).

Both TSH sister companies folded in April 2020 due to COVID. GoJet itself had to pause delivery of its ~30 still pending aircraft, and operation of its 47 delivered aircraft. With spectacular market timing possibly even worse than mine, GoJet announced in early February 2020 that it would further increase its fleet, which obviously went nowhere since COVID started (just like all of us).

So now you have a holding company TSH, and its massive infrastructure designed to be upheld by the cashflow from 3 subsidiary airlines, only currently being supported by basically half an airline. No bueno.

Add to the mix that TSH’s owner Hulas Kanodia is 72 years old. This dude is ancient and is highly motivated to look for an exit of this (presumably) doomed business.

When TSA went under in 2020, its entire fleet was transferred over to ExpressJet, another United Express carrier. Could I see the same thing happening with GoJet’s fleet being transferred to Air Wisconsin? Absolutely.

Is it possible Liam Mackay came up with this very plan himself and decided to come to Air Wisconsin to execute it himself? Absolutely.

Now, this “M&A” of sorts could happen in a variety of ways and it’ll be impossible to tag a precise valuation given GoJet is private, so I’ve modeled the below all-stock acquisition of GoJet’s assets (rather than an equity sale/merger) which strips out all the hair from GoJet, and I’m sure at this point GoJet is VERY hairy.

Directionally, this projects ~$10 post dilution.

Most assumptions are similar to Scenario 3 except the type of plane, and the purchase of the assets instead of leasing.

Alternatively, Air Wisconsin could also be rolled into UAL proper like ExpressJet and CommutAir, or it could merge with GoJet or be acquired by TSH etc. A whole host of combinations could happen, but the very rough ~$10 range is what I would expect for any case where Air Wisconsin undergoes a transaction to own a large fleet of upgauged aircraft.

Again, if there’s any type of transformative transaction, the terminal cashflow will massively increase NPV beyond the $2.17 liquidation value to ~$6 - $10.

Investment Merits

Incredible Risk Reward Profile

The biggest highlight is the robust risk profile; the word is overused but the risk here is truly asymmetric. The 2023 liquidation value, if HRBR were to go bust in 2023, is around $2.17… As in, in the worst case if you hold through Feb 2023, you’re guaranteed around $2.17 at the very end.

I hope I’ve made it crystal clear why a liquidation in 2023 is extremely unlikely. On top of that, any continued capacity agreement (Case 2) would moderately appreciate price, and any transaction (Case 3 or 4) would massively, MASSIVELY increase the value of the company to $6 - $10.

At $2.10, $HRBR is basically a free call option expiring in Feb 2023.Management Alignment

A very critical piece of this thesis is alignment with Liam Mackay’s and the Board’s interests.

One key stakeholder, Liam Mackay, was previously the Director of United Express Commercial Strategy. He 100% knew what was going on behind the scenes and decided, at age 36, to uproot his life and solid career at United Airlines to move to Appleton, Wisconsin, to work at a lower-tier regional airline that’s about 100x smaller for a very average C-suite compensation package. Would he do that if he knew the company was liquidating in 2 years? Or even phasing out over 5 years? I contend he’d only do this if there was something truly transformative at Air Wisconsin happening soon, and Mackay of all people would be the first to know.

Secondly, look at the Board. It consists ofRichard Bartlett: a lifer at Air Wisconsin and Princeton BA and Yale JD with 30 years of aviation and PE veteran

Nolan Bederman: U of Toronto JD/MBA and founder of an industrials PE firm

Kevin Degen: MBA from Harvard and Engineering BS from Princeton, and founder of a transportation focused Investment Bank.

This is the most stacked board I have ever seen in a company this small, do you really think they’d sunset this thing so quickly? Bederman is only 48, the other two are 62, they’ve got plenty of gas left to milk this cash machine.

Risks

The biggest risk, which has always been the biggest to me, is the fact that this is a controlled entity. Those 3 guys control Amun and Southshore, which controls 51% of HRBR, and they have a ton of control beyond just voting rights. Forget about any minority rights.

It’s a bit of a double edged sword that this group of investors is so sophisticated; on the one hand I’d trust them to self-deal and milk every last drop of money out of Air Wisconsin, but on the other hand I’m constantly thinking about how they might screw over minority owners.

Mitigation

However, it just so happens that now is a fantastic ceasefire from this risk because their hands are tied (for now).

If I were them, here’s how I would cash out; either build a fantastic company out of Air Wisconsin and do a strategic sale to United (which would be great for equity) OR just milk the cow and pay out a special dividend when there’s nothing left to milk.

Now, the first situation would be ideal, since equity would appreciate. Indeed management laid out a buyback plan on March 31, 2021, so maybe this is in the works after all. Plus, with equity now more than 10x more valuable than last year, it has become more valuable for any potential stock deal for bigger planes. Recall that they did a pref deal with Southshore to buy out a bunch of leased jets just a few years ago—I could definitely see this happening again now that HRBR equity is so much more valuable.

On the other hand, the second situation would be super sh*tty for minority holders because you can bet that special divvy is only for preferred owners. HOWEVER, this is incredibly critical—because of the PSP payments that HRBR has taken from the government, it cannot pay any dividends before April 2022.

So the biggest risk is nullified for almost a whole year!

Conclusion

I hope I’ve made it clear that a liquidation is not happening in 2023. Even in that case, HRBR is worth around $2.17. Any shred of evidence of going concern would massively boost HRBR’s price to $6+.

In addition, the trade is aligned with management and the board’s interests, and despite the risk of being a controlled entity, the board’s hands are tied through April 2022 because of PSP-covenants restricting dividends.

At $2.10, HRBR is essentially a risk free call option through March 2023, and only begins to bear any sort of risk after April 2022. A risk adjusted valuation results in $5.65, a 270% upside with very limited downside.

Catalysts

Q2 Earnings on 8/16/21

More details regarding UAL strategy released by United or Air Wisconsin

Flight data from Air Wisconsin’s new jets

Additional certifications on FAA website

Disclaimer: At the time of writing I am long HRBR.

The above references my opinion and is for information purposes only. I am not being compensated by any company or persons mentioned in this article. The opinions stated here do not represent my employer’s opinions. All information used is publicly available or reasonably obtainable and assumed to be factual. This is not intended to be investment advice. Investing in unregulated securities bears extremely high risk.

Appreciate the update. Coming up to speed, a few questions:

- On the preferred, equity issue is capped at 16.5m shares but given the low conversion price of .15c, arent there still ~3.2m shares that need to be paid out in liquidation at issue price? Plus some incremental capped dividends?

- In your liquidation analysis, you mark the $21m in receivables as part of a "one-time" due to the amendment. But wasn't that booked in revenue in 2020 and is already in the LT receivable note? Definitely have some excess receivable (vs. the normal 5-9m per quarter) but confused by the language as one-time..

- Would be curious as to your take on this thread, specifically the earnings potential https://twitter.com/RisingAlbatross/status/1410087963313254403 and vs MESA (not me btw, just interested in getting up to speed on the name). I struggle to get above ~$30m in levered FCF in 2022 which is quite a bit below the $40m+ I see thrown around.

Great work.

Looking forward to your comments on the latest earnings report which looked very good. Balance sheet nicely improved.