RENN: lawsuit special situation involving SoFi, Chamath, and SoftBank

Activist sues RENN CEO Joe Chen, SoFi, SoftBank to 3x the RENN market cap. Chen is motivated to settle within 3 weeks to progress the IPOE de-SPAC.

5/18/21 Update

An order of attachment was proposed for $560m. If this is granted the case is pretty much in the bag. If you read through Borrok's language in past documents, it's almost certain that plaintiffs will win. It was always a concern of realization of the assets (and for me personally a matter of time and IRR since I’d really prefer not to wait til the 2022 trial result), so if a pre-trial attachment is indeed granted then the assets are secured and it signals an even higher likelihood of winning since a pre-trial attachment is rigorous and a drastic remedy. In this case Chen will be much more likely to settle, bringing the timeline forward. Alternatively, we drag into 2022 with a highly likely win.

5/15/21 Update

Hope this hearing update made your Friday better! (screenshot below)

Defendants have until 5pm Monday 5/17 to produce an affidavit for attachment that shows the beneficial owners of the shares, and any proceeds from the sales of these shares. Attachment is used both as a pre-trial provisional remedy and to enforce a final judgment, including as a pre-requisite for a writ of attachment to seize assets (the SoFi shares).

And here’s a link to OG Borrok’s order plus I’d like to highlight the especially damning language in this section:

I thought a settlement was the most likely outcome but now it seems OG Borrok has turned up the heat and could be looking to seize those SoFi (and other OPI companies) shares. Even if Joe Chen does produce the affidavit in time, it’ll (likely) show the discrepancy vs. what he paid RENN shareholders in the OPI takeout, which would make the lawsuit even more ironclad. OG Borrok states his opinion:

FYI trading volume for May 15 strike calls was 25x normal volume and someone (not me but I have a good guess as to whom) executed a massive block order at 2:05pm, and 1,800 contracts were traded between 2-215pm, on an open interest of 160 contracts the previous day :)

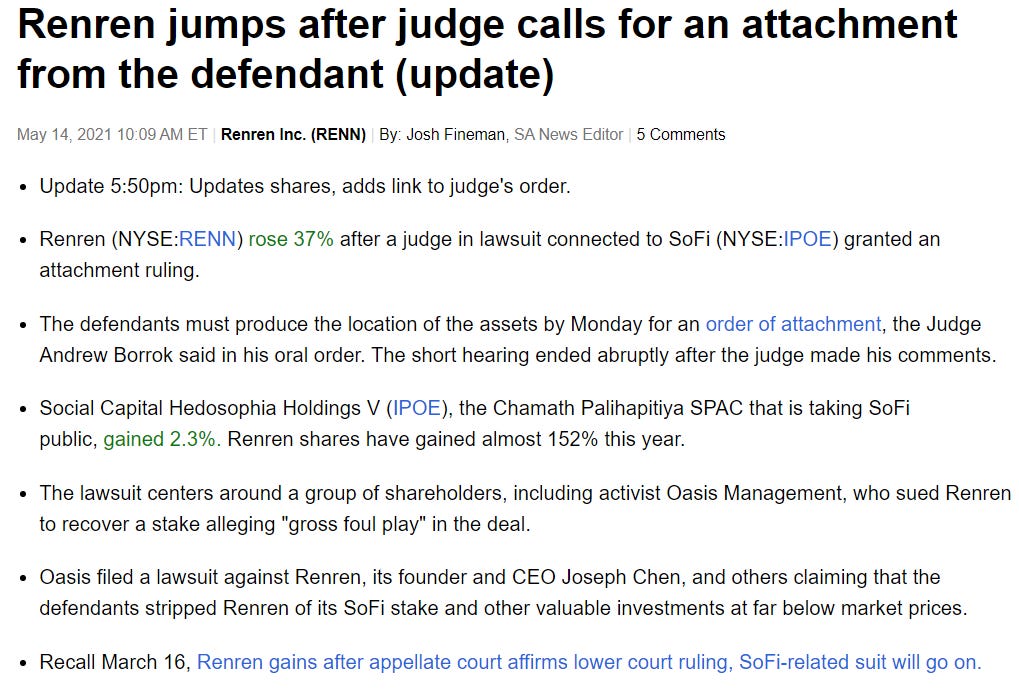

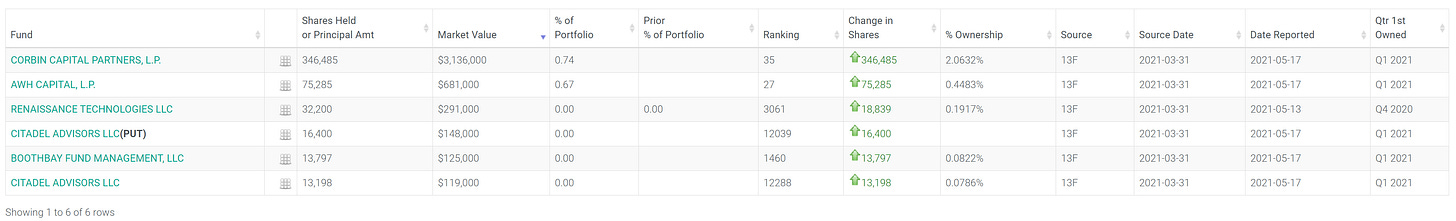

A couple big name hedge funds disclosed positions in RENN.

4/26/21 Original Post

Summary

RenRen (RENN) shareholders including famed activists Oasis (15% shareholder) are suing CEO Joe Chen for a predatory deal in 2017 that wrested a 15% stake in SoFi at a rock bottom valuation away from RENN. The trial is set to begin in December 2021, but with Chamath’s IPOE aiming to close the SPAC deal with SoFi in the next month, and most importantly Judge Borrock of NY unexpectedly entering a Show Cause order last week for Joe Chen to explain why he SHOULDN’T be barred from selling SoFi shares by May 14, the timeline has just been catalyzed significantly.

If Chen wants to cash out on his SoFi shares (and keep his SoFi board seat), and if Chamath wants to close this SPAC deal soon, Chen is very motivated to settle the suit before May 14, which I’d argue is likely. The lawsuit claims $500m in damages to be returned to RENN shareholders, which would triple RENN’s current market cap of $250m ($10 per share).

Like the previous NTP lawsuit special situation trade, not only is this a very simple outcome to model, it is also time bound. Most importantly, the risk/reward of current call options prices are astoundingly attractive. This is basically a big math question and the answer is:

I expect 160% risk-adjusted returns in 3 weeks, with potential for significantly more in the case of a large settlement.

In the NTP trade where expected risk-adjusted return was 70%, the actual return was in excess of 800% when the lawsuit was won. A cash settlement is more likely than with SoFi shares, but in the event of either, RENN shares would be worth $25+ (cash settlement) or $100+ (SoFi stock settlement) compared to the $10 right now. In addition, downside is limited for options by design, and even for equity, RenRen’s stake in their core business Kaixing (KXIN) is worth around $5.50 per share.

In summary, this is a very asymmetric yet timeboxed bet. Clock is ticking for Joe Chen and I like the odds of a quick settlement with limited downside protection from KXIN and options, with the 10x upside optionality of winning SoFi shares.

Sections:

Background

Catalysts

Valuation

Risks

I: Background

Here’s the summary:

Chen tried to steal SoFi in 2015, failed.

Chen strongarms a take-private deal in 2018 through OPI.

Everyone is pissed, and Oasis sues in 2018.

We got a trial in December 2021.

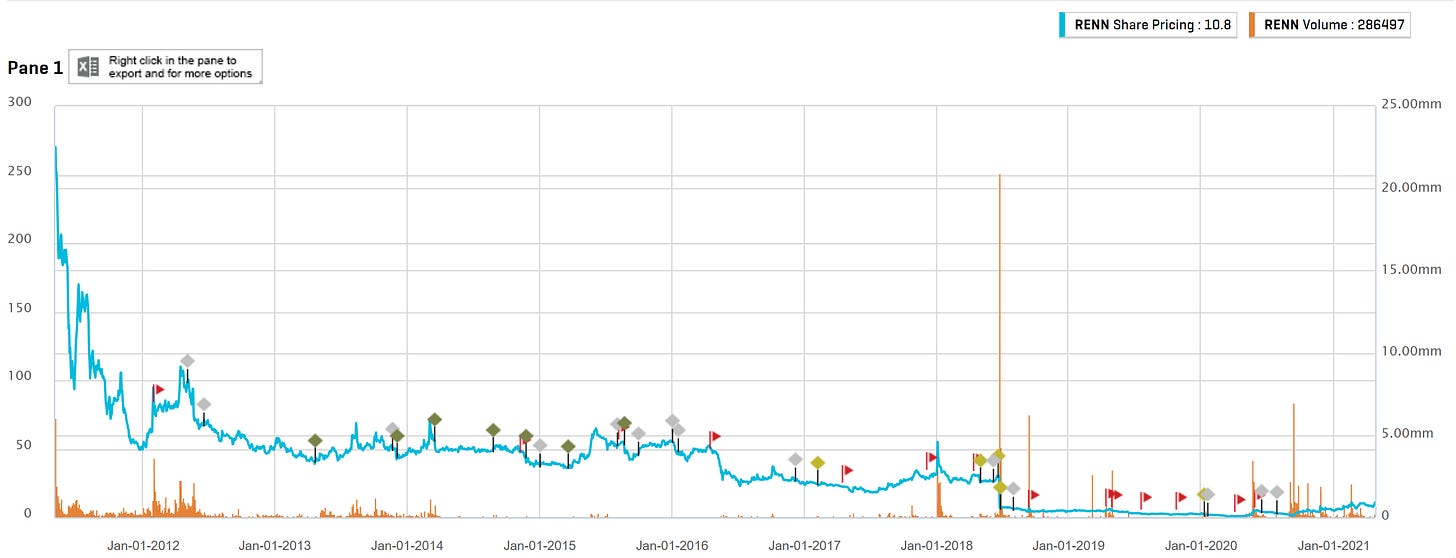

2011: RenRen flops

RenRen (NYSE:RENN) was intended to be a Chinese Facebook in the early 2010s that flopped upon arrival, but management kept the IPO funds and turned it into a used-car sales SaaS (Kaixin) in 2016 plus a decent VC. You’ve likely never heard of most of their PortCos (GoGo, Eall, Golden Axe, StoreDot, Motif, LendingHome, Eunke, Snowball, 268V, Omni, Hylink) EXCEPT for SoFi (25% stake). They could have just kept the show going with the SoFi golden goose and we’d be reading very different headlines about Joe Chen today, but nope, greed took over.

2015: Chen tries to take SoFi private but fails

In 2015, RENN CEO Joseph Chen (who is a US citizen and resides in the US—more on this later) tried and failed to offer a take-private deal of $1.4b for RENN assets. No pretext here, but I read this as “Chen saw the potential of SoFi and wanted the whole thing on the cheap”. For reference, SoFi raised at a $1b valuation just a month later further infuriating shareholders. This year, SoFi was valued at $8.65b at SPAC in January 2021, and IPOE (its SPAC vehicle) is currently trading at an implied $16b valuation.

Chen wanted SoFi gains to himself, at the expense of shareholders. Obviously shareholders did not accept; a large shareholder wrote to the board calling the offer “offensive and ludicrous” and “reflects the greed and almost immoral disposition of Chen and Liu”. Yikes.

2016 - 2018: Chen strongarms SoFi deal

Fast forward to 2016, Chen now tries hardball. In a *HIGHLY SUS* deal which the lawsuit today is trying to reverse, RENN sold off 44 of their holdings, including SoFi, to a vehicle called Oak Pacific Investment (OPI) and its subsidiaries. According to OPI’s offering circular, it's book value was $530m on September 31, 2017 (57% of the book value was in US companies—more on this later). This was also according to RENN’s 2017 20-F, 93% (so basically all) of RENN’s $565m book value on December 31, 2017 (compare this to the $1.4b offer 2 years ago YIIIKES).

To come up with this $530m figure, Chen created a Special Committee, which consisted of 3 people: himself, his executive coach Stephen Tappin, and his friend and former RenRen CFO Pu Tianruo.

Chen and his Special Committee also hired an “independent valuation advisor” Duff & Phelps, who concluded that OPI’s SoFi stake was worth between $483 million to $587 million—wow how convenient that it brackets Chen’s previous failed $500m offer for SoFi.

And what’s worse, D&P applied a 40–50% discount to the already low SoFi valuation because, according to the Offering Circular, “there is typically a discount” in “purchases and sales of large blocks in private companies and secondary sale transactions for private companies.”

Check out how D&P’s resulting “valuation” for SoFi compared to other historical valuations:

By the way, that SoftBank valuation of SoFi is what Chen himself used to secure a loan from SoftBank to fund the cash dividend for OPI that gave SoftBank any upside in SoFi through 3.5m shares. I mean C’MON basically he said OK Masayoshi our SoFi stake is worth $17.18 per share so can I borrow some cash to pay off the shareholders and you can get the upside on SoFi? Then immediately turned around to shareholders and said OK shareholders here is $9.17 for SoFi and 43 other companies, now STFU.

It’s honestly egregious—and this is just SoFi and implies that SoFi alone would have been worth more than the $530m sale to OPI. Forget about the other 43 PortCos. I’m gonna save some space, read about all the other D&P “valuations” on the lawsuit hosted here, page 62.

Further add to the mix that at the time, D&P itself was in talks to be acquired for $1.75b by Permira (a PE fund who may or may not have its own hand in this pot). Permira actually sold D&P last year for $4.2b so good on them, but ironic that this was a machine inside another bigger machine...

2018 June: Shareholders get eviscerated

Anyway, as a result of the OPI offering, RENN shareholders could either take a sh*tty special cash divvy (aka hush money) or participate in a PIPE for equivalent ownership in OPI EXCEPT OH WAIT only accredited investors can do PIPEs (aka no poor people allowed).

For what its worth, even accredited investors got screwed in the new vehicle. The Circular notes participating stockholders would “have no power to change the composition of the board of directors” and that Chen and Softbank could unilaterally “revise [OPI’s] articles of association” without any stockholder vote. In addition, shareholders of OPI would “experience immediate and substantial dilution” because OPI would issue over 136 million options and 6 million restricted shares to Chen and other insiders immediately after the Transaction”.

WTF.

In the end everyone got the pipe one way or another. For any aspirational robber barons reading this: if you’re trying to screw over poor people, just do that, don’t get greedy and try to screw over rich people too. Or just don’t do any of this, my god…

2018 July: Oasis sues RENN

In June 2018, the special cash divvy of ~$9 was paid out (aka forced the little guys to take paltry hush money), RENN stock price was eviscerated, and Chen walked away scot-free WRONG.

Enter our lord and savior, Oasis Capital Management (aptly named), an activist fund who has been specializing in Asian special situations since 2002, who filed a 5.3% stake in RENN in July 2018 AND this legendary lawsuit against RENN (revised 2021).

2020 May: Judge says there will be a trial

Chen and gang tried to argue that Oasis and gang couldn’t sue because this is a Chinese stock (with ADRs in the US). There are many instances of US activist funds trying to sue (many) Chinese companies but nothing usually happens because assets are in China. But remember that Chen is a US citizen who lives in the US, 57% of companies sold to OPI were American, and most importantly, SoFi is domiciled in the US. So in this case, if the plaintiff were to win, the US court CAN seize Chen’s assets.

And that’s what happened in May 2020, New York Supreme Court Justice Andrew Borrok yelled on Zoom that New York indeed had jurisdiction over the defendants in this legal case and that the lawsuit could continue, and laid out this timeline:

Basically, by December 2021, a Note of Issue will be delivered, aka the trial will begin.

Immediately following this notice in June 2020, Oasis doubled its stake in RENN to 10%.

In September 2020, Oasis tripled its original stake to 15.2%.

NOW WE’RE COOKING WITH GAS FELLAS.

So let’s recap:

Chen tried to steal SoFi in 2015, failed.

Chen strongarms a take-private deal in 2016 through OPI.

Everyone is pissed, and Oasis sues.

We got a trial in December 2021.

Catalysts

OK trial in December with a very damning lawsuit, great but why the fuss now? Here’s why this situation became ultra-juicy as of last week:

January 7: SoFi SPACed with Chamath’s $IPOE and Chen is supposed to stay on the board (according to their website).

Mid January: Chen and Oasis reportedly met privately to negotiate a settlement but did not come to an agreement, no amount disclosed.

February 7: Chamath gets exposed for omitting a DoJ investigation in his Clover Health (CLOV/IPOC) S-4, he unloads on baggies, shares tank, SEC is not happy.

March 31: IPOE provided an amended S-4 that mentioned the Chen lawsuit for the first time, and that SoFi and SoftBank had also become defendants for transacting in basically “embezzled assets” so now it’s a visible sore to anyone interested in IPOE, and not just RENN.

April 15: MVP Justice Andrew Borrok enters "Show Cause" order with deadline of May 14, 2021 for OPI to show proof and explain why Chen should NOT be barred from selling any more SoFi shares.

April 22: IPOE reported that they cleared up a warrant accounting issue and are now locked and loaded for SEC to approve to S-4 (usually 1-2 months).

Let me spell it out for you:

Joe Chen (+ Chamath + SoftBag + SoFi) want the SEC to approve the de-SPAC deal quickly to cash out. But the SEC has a closer eye on Chamath now because of the Clover shitstorm, so they're unlikely to approve the merger unless this lawsuit is cleared up (either by settlement or tossing Joe Chen from the board since Joe and gang are not gonna wait until 2022 for the trial to finish to get this deal done).

Joe Chen has demonstrated his motivation to settle the lawsuit, but Oasis has also demonstrated they're not messing around when they say they want $500m. Finally, all this has been vigorously sped up by OG Borrock's Show Cause order and SoFi's newly amended S-4 last week.

Literal MAYHEM = great time to make some money.

Valuation

I’m removing the December trial from the scope of this analysis. The bet for me is much more short term on whether Joe Chen will make a settlement before May 14, and if so how much. Like the NTP trade, this is a pretty binary (or rather ternary) situation. Either:

Chen provides a strong case by May 14: RENN tanks

Chen fails to Show Cause or provides a “weak” defense before May 14 but there is no settlement (for now): RENN might pop or melt up (I modeled flat to be conservative) and IPOE might dip

Chen settles before May 14: RENN pops depending on the settlement amount

There are some other scenarios in between but I think these are the three most likely. Given the situation, I think the most likely (and easiest solution for all parties) is for Chen to cash settle to keep his SoFi board seat and not postpone the de-SPAC. Conveniently, both Judge Borrok and Chamath have timeboxed the trade for us. Chen and OPI have until May 14 to explain why he should not be prevented to sell his SoFi shares, AND based on the IPOE filing on April 22, IPOE should be targeting closing this deal in 1-2 months, which is also around late May.

Basically the ideal trade would take an asymmetric upside short term bet for case 3 and limit downside in case 1 for a mid-May expiration.

I’ve done some scenario probabilities below to get an expected payout based on a few past comparable cases:

The precedent cases were used below to estimate the attorney fees of ~23% and a base case gross settlement of 50% of sought damages.

The options contracts below are the most liquid and make the most sense for this trade, priced forward using Black-Scholes holding IV constant (usually IV spikes in event driven scenarios):

My weighing across these instruments lands a roughly 160% expected return in about 3 weeks.

Base case expected return on equity is ~40%, and conservatively 15%.

Check out my NTP article for a deeper breakdown of the option pricing and probability analysis.

Considerations

There are a couple things to keep in mind:

Payout

A question mark is how a settlement would be paid out. The $137.5m Freeport-McMoRan settlement was paid out via special dividend to current shareholders; this is unusual but at least there is a precedent for a large settlement being paid this way, which would be the cleanest outcome for this trade.Price optics

Price has already jumped 25% or so since last week after Judge Borrock entered the Show Cause order, so some folks are likely looking to take profits and optics/technicals aren’t fantastic. In fact, I suspect another firm CRCM who entered this trade around $2-3 was likely exiting in Feb and mid-March, which caused this bid wall around $10. The good news is someone is buying in size (hopefully Oasis) at $10, and I’m happy to be buying with Oasis. I’ve seen similar price movement in LVJI in October 2020 after a PIPE, where there was a bid wall that broke after the share transfer was complete, only to bottom out and then pop.Options illiquidity

Equity liquidity is solid but options are pretty illiquid and the open interest for the above-mentioned instruments are only a few hundred contracts each, so if you’re moving size I’d suggest sticking with equities.

Disclaimer: At time of writing I am long RENN. No position in NTP, LVJI, IPOE, CLOV.

The above references my opinion and is for information purposes only. I am not being compensated by any company or persons mentioned in this article. The opinions stated here do not represent my employer’s opinions. All information used is publicly available and assumed to be factual. This is not intended to be investment advice. Investing in unregulated securities bears extremely high risk.

Newest update:

https://www.docdroid.net/GEvz7Rg/653594-2018-in-re-renren-inc-derivative-litigation-v-xxx-stipulation-so-or-649pdf-pdf#page=3

Any news/update behind the move today?